101 Economists to Congress: Keep the Cadillac Tax

In light of the recent reconciliation package that repeals the Cadillac tax on high-cost health insurance plans and Democratic Presidential candidate and former Secretary of State Hillary Clinton's (D-NY) call for repeal, 101 economists -- including CRFB board members Robert Reischauer, Alice Rivlin, and Eugene Steuerle -- wrote a letter to the Chairmen and Ranking Members of the House Ways and Means and Senate Finance Committees recommending that they spare the tax.

The letter cites three main reasons to keep the tax. First, the tax will help control health care costs by discouraging overly generous employer-provided health insurance plans. Second, it could help wage growth by reducing the share of employee compensation that goes toward insurance. Finally, repealing the tax would cost $91 billion over the next ten years. The letter concludes that:

We, the undersigned health economists and policy analysts, hold widely varying views on other provisions of the Affordable Care Act, and we recognize that measures other than the Cadillac tax could have been used to restrict the open-ended health insurance tax break.

But, we unite in urging Congress to take no action to weaken, delay, or reduce the Cadillac tax until and unless it enacts an alternative tax change that would more effectively curtail cost growth.

The points the letter makes are valid and are worth expanding on. For background, the Cadillac tax, a 40 percent excise tax on insurance plans whose premiums exceed a certain threshold, is an indirect way to limit the largest tax expenditure in the code: the exclusion for employer-provided health insurance. The exclusion exempts employer-paid premiums from taxation, thus encouraging employees to get more of their compensation in the form of health insurance. The exclusion and the Cadillac tax, as the letter indicates, represent an interesting cross-section of health care policy, employee compensation, and the budget.

Controlling Health Costs

Economists generally agree that more generous health insurance plans -- ones that cover more services and/or have less cost-sharing -- drive up health care costs by making patients less conscious of the cost of the care they are receiving, causing them to use more services than they otherwise would. The health exclusion encourages more generous plans by making employer-paid premiums tax-free; the Cadillac tax attempts to curb this incentive. Thus, the tax should help to control health care costs by accelerating the trend toward less generous or high-deductible plans.

Increasing Wage/Salary Growth

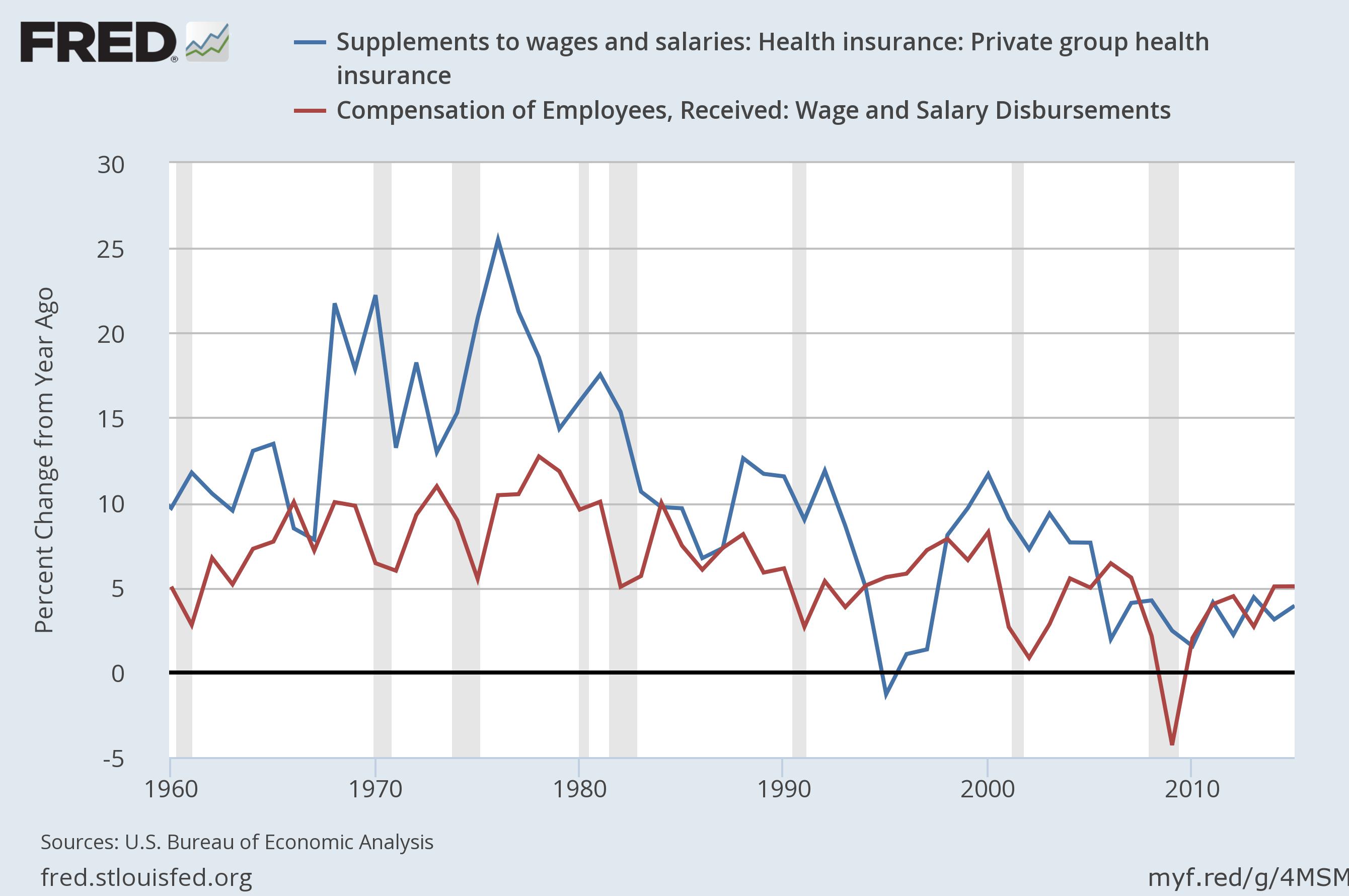

For much of the past several decades, health insurance costs have grown faster than wages and salaries. Economic evidence generally supports a trade-off between compensation received in the form of health insurance and in the form of wages or salaries (though of course many other factors help determine wage growth). Thus, by slowing the growth of premiums, the Cadillac tax should increase the share of total compensation that they receive in wages/salaries. This effect is closely tied to the next point.

Raising Revenue

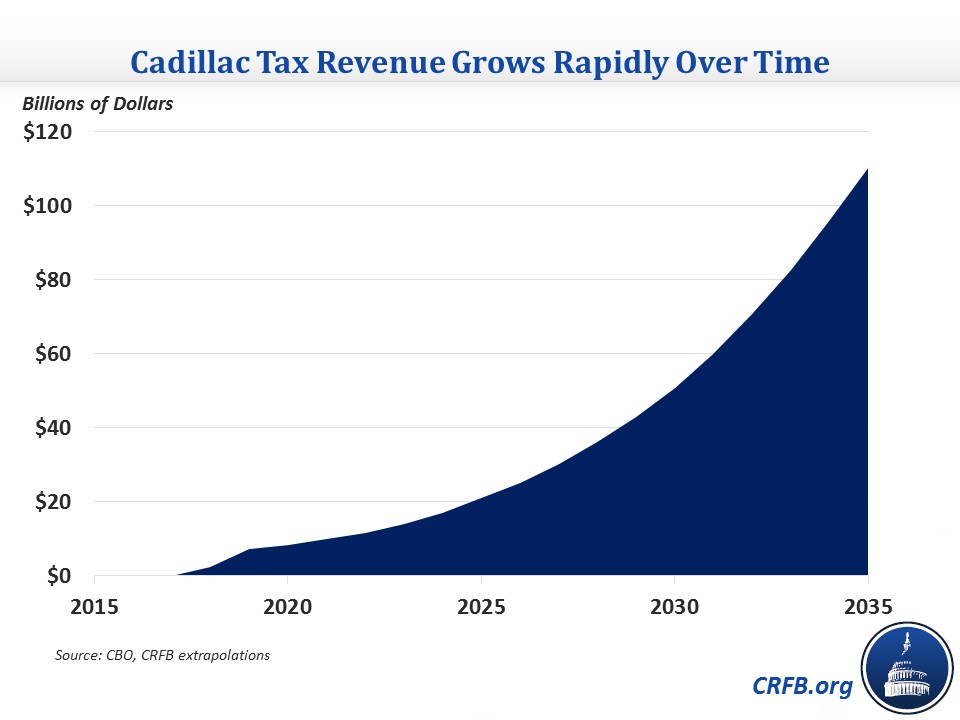

As the letter indicates, repealing the Cadillac tax is expected to cost $91 billion over ten years. But as we indicated previously, the tax will raise significantly more over the longer term because the thresholds are only indexed to inflation, which tends to grow more slowly than premiums. CBO has estimated that the tax will raise 0.5 percent of GDP in 2040, compared to 0.1 percent in 2025.

Importantly, the tax itself accounts for only one-quarter of the revenue effect, with three-quarters of the effect coming from the changes in compensation to avoid the tax.

The economist letter makes clear the health care, budgetary, and economic stakes of repealing the Cadillac tax. Because of the nature of the problem it is trying to correct, we agree that it should only be repealed if it is replaced with another structural policy that helps to control health care costs -- like limiting the health exclusion. Several groups from across the political spectrum, including the American Action Forum, Brookings Institution, the Bipartisan Policy Center, the Cato Institute, and the Center for American Progress, have supported exactly that.