Statement on President Trump's Tax Speech

For Immediate Release

Committee for a Responsible Federal Budget president Maya MacGuineas released the following statement in response to President Trump's speech today on tax reform.

President Trump is right to focus on improving the tax code.

The U.S. tax code is filled with $1.6 trillion of deductions, credits, and other tax preferences for special interests. Individual and corporate taxes alike are overly complex, anti-competitive, and costly to comply with.

A simpler and fairer code with a broader base and lower rates will go a long way to increase economic growth; however, a plan that adds to the debt will deflate and suppress that growth.

Sustained 3 percent growth or higher, as the President wants, is a tall order—with current demographic trends, it may very well be unreachable. And tax cuts that add to the debt will make an extremely difficult task even more unattainable.

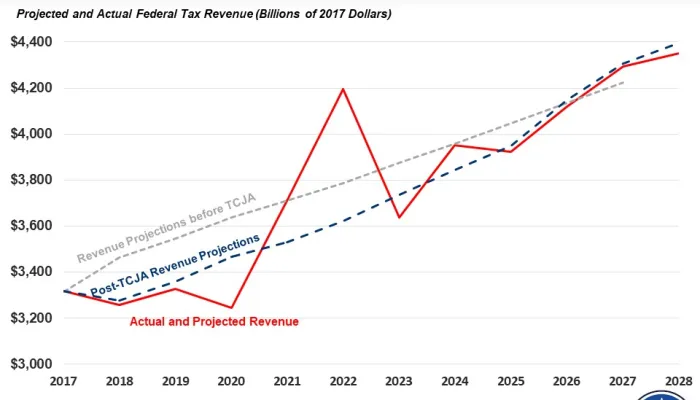

Our debt is at near record levels—projected to grow even higher as a share of the economy.

We encourage the President to pass generational tax reform that lifts up the American economy, put our debt on a downward path, and not pursue unpaid-for tax cuts that will provide nothing more than a short-term sugar high and an even deeper hole to climb out of.

Offsetting the cost of tax reform is the central ingredient in creating reform that grows the economy without exploding the debt. It takes work and leadership but will have far greater economic payoffs than free lunch tax cuts.

For more information, read our piece Tax Reform Should Not Add to the Debt – Here's 5 Reasons Why.

###

For more information contact Patrick Newton, Press Secretary, at newton@crfb.org.