Q&A: Gross Debt Versus Debt Held by the Public

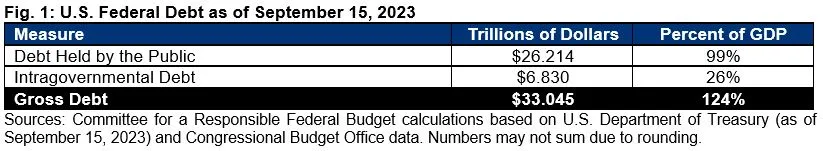

On September 15, 2023, the federal government's gross debt exceeded $33 trillion for the first time. This mark serves as an important reminder of the nation's unsustainable rising national debt. At the same time, the nominal amount of gross debt is just one of a few measures of debt and is actually considered less economically meaningful than some other measures, such as debt held by the public as a share of Gross Domestic Product (GDP). This explainer will lay out everything you need to know about the different measures of debt and what they mean for the government's fiscal situation.

What is the difference between debt and deficits?

Deficits are how much the country borrows each year, while debt is the total amount it owes. In other words, the deficit measures the flow of borrowing while debt measures the total stock of borrowing. The federal government runs a deficit when outlays (i.e., spending) exceed revenue, and it must borrow money to make up the difference. When revenue exceeds outlays, the government runs a surplus. The debt is the sum of all past deficits and surpluses (plus additional borrowing from federal credit and related programs) and reflects how much the government has borrowed over its history.

What is gross federal debt? How big is it?

The gross federal debt is the sum of virtually all debt the federal government owes, including what it owes to itself. Specifically, gross federal debt is the sum of debt held by the public and intragovernmental debt.

As of today, the gross debt is $33.0 trillion, up from $23.4 trillion in February 2020, before the COVID-19 public health and economic crisis necessitated massive short-term borrowing. Based on estimates from the Congressional Budget Office (CBO), we estimate that gross debt will rise to $50.8 trillion by the end of Fiscal Year (FY) 2033. As a share of the economy, gross debt is currently around 124 percent of GDP and is expected to rise to 129 percent of GDP by 2033.

What is debt held by the public? How big is it?

Debt held by the public is all debt that the federal government owes to those outside of the federal government. It includes debt held by individuals, businesses, banks, insurance companies, state and local governments, pension funds, mutual funds, foreign governments, foreign businesses and individuals, and the U.S. Federal Reserve Bank. However, it does not include intragovernmental debt.

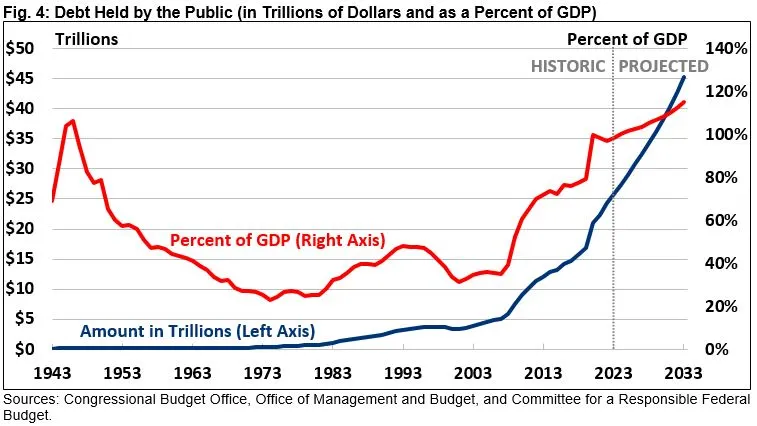

As of today, federal debt held by the public is about $26.2 trillion, up from $17.4 trillion in February 2020, before the COVID-19 crisis necessitated massive short-term borrowing. CBO projects debt held by the public will rise to $45.2 trillion by the end of FY 2033. As a share of the economy, debt held by the public is currently around 99 percent of GDP and is projected to reach a record 115 percent of GDP by 2033.

What is intragovernmental debt? How big is it?

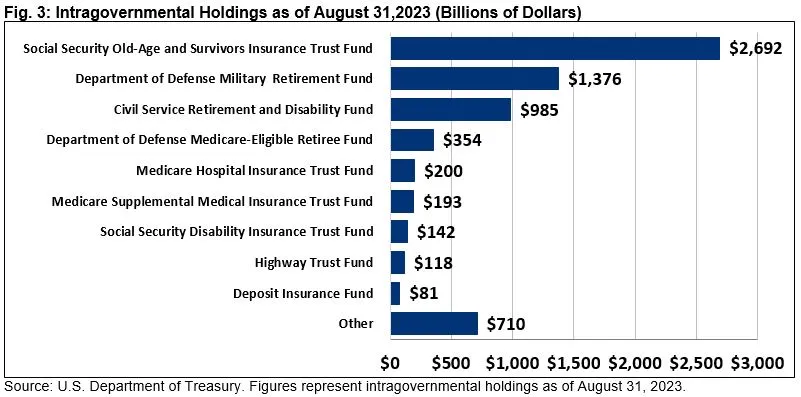

Intragovernmental debt is debt that one part of the government owes to another part. In almost all cases, it is debt held in government trust funds, such as the Social Security trust funds. These debts represent assets to the part of the federal government that owns them (i.e., Social Security), but liabilities to the parts of the government that issue them (the Treasury Department). Therefore, they have no net effect on the government's overall finances.

As of today, intragovernmental debt totals $6.8 trillion, up from $4.8 trillion a decade ago. However, it is projected to fall to $5.6 trillion by the end of FY 2033, as some major trust funds will soon be forced to begin selling off the debt they hold in order to continue covering their expenses.

Which is a more important measure of debt, gross debt or debt held by the public?

Both gross debt and debt held by the public are important measures, but for different reasons. Most economists regard debt held by the public – particularly as a share of GDP – to be the most economically meaningful measure of debt. Debt held by the public measures the amount of U.S. debt held by entities other than the federal government and traded publicly. It is thus relevant for understanding the extent to which debt is providing fiscal stimulus, crowding out private investment, influencing interest rates, and consuming fiscal space.

Gross federal debt also has some significance as one measure of the government's total obligations. With some minor adjustments, gross debt is also used to determine when the government has or will hit the national debt limit.

Are there other measures of federal debt?

There are several lesser-known measures of federal debt besides gross debt and debt held by the public. One is debt held by the public net of financial assets. This measure subtracts the government's financial assets – most significantly its student loan holdings, but also any stocks or bonds it may own – from its liabilities. For perspective, in FY 2022, financial assets totaled $2.0 trillion, so debt held by the public net of financial assets totaled roughly $22.3 trillion, or 89 percent of GDP. While debt held by the public net of financial assets does give a more comprehensive picture of federal finances, it may be difficult to calculate accurately, as it excludes nonfinancial assets like land and buildings, and it does not show the extent to which the government is leveraged.

Another measure of debt is debt subject to the limit. This measure, which matters for determining when we’ve reached the debt ceiling, is broadly similar to gross federal debt. However, debt subject to the limit excludes debt issued by agencies other than Treasury (such as the Federal Financing Bank or the Tennessee Valley Authority) and is adjusted for the unamortized discount on certain Treasury securities, making it about $96 billion lower than gross debt.

Broader measures of the federal government's financial condition take liabilities other than debt into account. According to the Fiscal Year 2022 Financial Report of the United States Government the U.S. has $39.0 trillion of liabilities, with publicly-held debt comprising about 62 percent of those liabilities and accrued benefits for veterans and federal employees making up most of the remainder. The government also has some softer liabilities (often referred to as "obligations") to pay future Social Security and Medicare benefits in excess of revenue under current law. The present value of these unfunded social insurance obligations over the next 75 years is about $75.9 trillion, bringing the government's total liabilities to $114.9 trillion. Net of government assets, the government's net position under this measure is -$110.0 trillion.

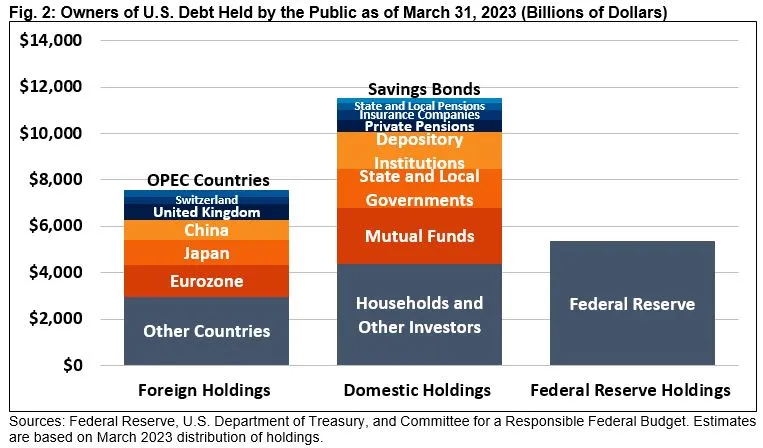

Who owns the national debt held by the public?

Of the $26.2 trillion of debt held by the public, over 30 percent is owned by foreign entities, roughly 50 percent by private and public domestic entities, and over 20 percent by the Federal Reserve Bank. The Federal Reserve has significantly expanded its Treasury holdings since the COVID-19 public health and economic crisis began in 2020.

Foreign holdings come from a mixture of foreign individuals, businesses, banks, and governments. Of the nearly $8 trillion of foreign-held debt, over 14 percent ($1.1 trillion) is held by Japan and 12 percent ($869 billion) is held by China. The next largest holders are the United Kingdom, Belgium, and Luxembourg, who each hold between $329 billion and $705 billion of U.S. debt. On a combined basis, the Eurozone holds about $1.4 trillion, and Organization of Petroleum Exporting Country (OPEC) member nations together hold $256 billion of U.S. debt.

In terms of the roughly $12 trillion of domestic holdings not held by the Federal Reserve, a large share is held by the financial sector. Mutual funds hold 20 percent of domestic debt holdings not held by the Federal Reserve, depository institutions hold 13 percent, private pension funds hold 4 percent, and insurance companies own 3 percent. About 14 percent is held by state and local governments, who invest in "State and Local Government Series" securities as a way to comply with federal tax laws and anti-arbitrage regulations when they have funds from issuing tax-exempt bonds, and another 3 percent is held by pension funds for their employees. About 2 percent is held by the owners of savings bonds, which are sold directly by the Treasury and are not traded on the private market. The remaining 36 percent is held by other investors, including households, nonfinancial businesses, and Government-Sponsored Enterprises (GSEs).

Finally, the U.S. Federal Reserve currently holds about $5.0 trillion of government debt (not including debt held under repurchase agreements). Prior to the COVID-19 public health and economic crisis, the Fed held only about $2.5 trillion of federal debt. When the crisis hit, the Fed embarked on an aggressive round of Quantitative Easing, buying trillions of dollars in Treasury and other securities using newly created money in the hope of stimulating the economy. In response to inflation running well above the Fed’s 2 percent target, it ended its quantitative easing program in March of 2022 and reinvested any maturing securities to maintain the size of its balance sheet. In June of 2022, the Fed began implementing Quantitative Tightening to restrain economic activity and tame inflation. Such actions are currently reducing the Fed’s balance sheet by about $60 billion per month. Still the Fed’s debt holdings are more than double their pre-COVID level.

What is the composition of intragovernmental debt?

Most of the $6.8 trillion of intragovernmental debt is held in government trust funds. About $2.7 trillion is held in the Social Security Old Age and Survivors Insurance (OASI) trust fund in the form of special issue securities that are expected to be redeemed within the next 15 years or so. A majority of the remaining amount comes from federal civilian and military retirement trust funds, which are projected to continue accumulating assets in order to notionally fund future retirement costs. Smaller amounts come from the Department of Defense’s Medicare Eligible Retiree Fund, Medicare’s Hospital Insurance and Supplemental Medical Insurance Trust Fund, the Highway Trust Fund, the Deposit Insurance Fund, and the Social Security Disability Insurance (SSDI) Trust Fund, among other sources.

When will gross debt reach the statutory limit?

Since 1917, the federal government has had a legal limit on the amount of debt it can accrue. The most recent $31.38 trillion debt limit was breached on January 19, 2023. On June 3, 2023, with enactment of the Fiscal Responsibility Act, the debt limit was suspended through January 1, 2025. During the intervening period, the Treasury Department was able to use "extraordinary measures" to avoid default.

When will debt held by the public reach its limit?

There is no legal limit to debt held by the public, nor is there a precise point where it starts to represent an economic threat. However, as debt held by the public grows larger as a share of the economy, the potential for economic damage grows larger, the amount of fiscal space available to policymakers grows smaller, and the risk of a fiscal crisis increases. With a growing national debt, a greater share of private savings would be used to purchase government debt instead of going towards private investments that increase productivity and long-run economic growth. Higher debt also means policymakers will have less ability to borrow easily in response to unforeseen emergencies or economic downturns. Finally, a large and growing public debt increases the risk that investors could at some point become unwilling to finance government borrowing without charging substantially higher interest rates, which could lead to a debt sell-off and cause a fiscal crisis.

How do current debt levels compare historically?

Both gross and public debt are at all-time highs in nominal dollars, which is perhaps not surprising since the federal government has been running deficits for each of the past 21 fiscal years. As a percent of GDP, both are high by historical standards. Debt held by the public is currently around 99 percent of GDP, which is higher than any time in history other than in fiscal years 1945, 1946, 2020, and 2021, when unprecedented borrowing occurred to finance the World War II effort and to fight COVID-19. Even during those two periods, the record for debt was 106 percent of GDP in 1946 and 100 percent in 2020, both of which the federal government will surpass by FY 2029.

Gross debt currently amounts to around 124 percent of GDP, which is the second-highest total in history, just short of the all-time record of 128 percent of GDP in FY 2020. By FY 2029, public debt will be at its highest level in history as a share of GDP, while gross debt will be roughly in line with the all-time record of 128 percent of GDP.

Why measure debt as a share of GDP?

The ratio of publicly held debt to GDP is a better measure of a country's fiscal situation than just the nominal debt figure because it shows the burden of debt relative to the country's total economic output and therefore its ability to finance or repay it. This measure also allows for an apples-to-apples comparison of one country's fiscal situation over time or multiple countries' debt burdens in a meaningful way. A large nominal dollar debt is less of a problem if a country has a large economy and can easily repay it. For example, debt held by the public in FY 1946 was about $242 billion, or one percent of what it is today. But with a GDP of just $228 billion, debt held by the public was 106 percent of the economy, or roughly 7 percentage points higher than its current level.

How do budgetary changes affect debt?

Since public and gross debt are different measures of debt, changes to the federal budget can affect each measure differently. Any change to the unified federal budget that affects deficits will affect debt held by the public as well. For example, a law that reduces ten-year deficits by $50 billion will generally reduce public debt by $50 billion. The same is not necessarily true of gross debt, since any change that affects a program with a trust fund would have offsetting effects on gross debt. For example, a policy change that increases Social Security's trust fund by $50 billion would reduce debt held by the public by a similar amount but increase intragovernmental debt by $50 billion and therefore have little or no impact on gross federal debt.

What's Next

-

Image

-

Image

-