The Better Budget Process Initiative: Improving Focus on the Long Term

For additional budget process resources including specific options for reform, visit our Better Budget Process Initiative home page.

The budget process focuses on the short term, often at the expense of longer-term considerations. This distortion allows policies to be crafted in ways that mask their true costs, and produces results that downplay looming fiscal challenges. The short-term focus leads to many poor outcomes, such as emphasis on short-term deficit reduction (with little improvement in the long-term fiscal outlook), the use of “timing gimmicks” designed to obscure the budgetary impact of policy choices, and the reliance on one-time savings are to ensure “deficit neutrality” within a budget window but deficit increases beyond it.

The short-term focus also causes policymakers to undervalue policies which produce modest savings in the near term but grow significantly over time, including changes to gradually slow the growth of health and retirement programs, or that exempt current beneficiaries of a given program or tax break.

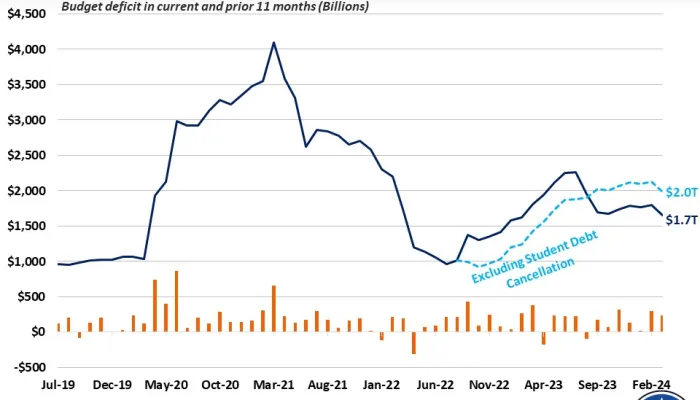

In addition, the short-term focus has led many in Washington to brag that the fiscal situation is under control based on a short-term improvement in the deficit despite the fact that the debt is projected to grow faster than the economy over the medium and long term. (see Deficit Falls to $483 Billion, but Debt Continues to Rise)

The short-term emphasis is the result of both an overreliance on ten-year budget windows for scoring and analysis, and insufficient enforcement of long-term fiscal goals. Modifying the rules governing the budget process could be a powerful tool to help correct this myopic thinking. We suggest several possible remedies:

- Require long-term estimates for significant legislation

- Codify rules prohibiting legislation from increasing long-term deficits

- Allow long-term savings targets for reconciliation

- Establish a second-five-year test for PAYGO

- Require annual budget documents to include long-term information

- Expand the use of accrual accounting where appropriate