Analysis of the 2021 Medicare Trustees' Report

The Social Security and Medicare Trustees released their annual reports on the long-term financial state of those programs. The reports are the first to incorporate the effects of the COVID-19 pandemic, recession, response, and anticipated recovery. You can read our analysis of the Social Security Trustees report here.

The Medicare Trustees’ report shows that the Part A Hospital Insurance trust fund will be insolvent in just five years, the trust fund faces a shortfall of 0.77 to 1.61 percent of payroll, and Medicare spending will grow significantly over the next few decades. Specifically, the Medicare Trustees found that:

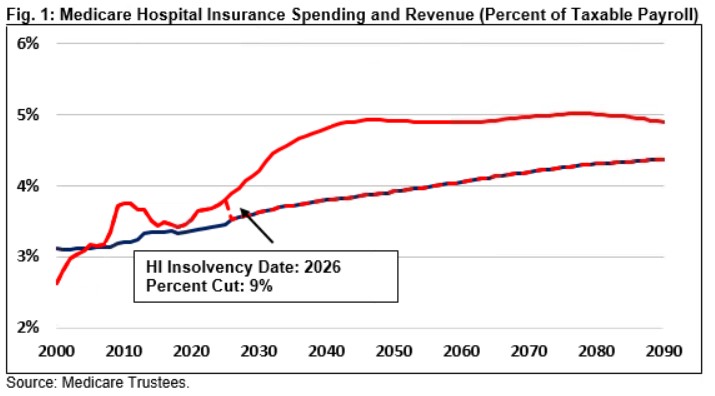

- The Hospital Insurance (HI) Trust Fund is Only Five Years from Insolvency. The Trustees project the trust fund will be depleted by 2026, the same year they projected in their prior (pre-COVID) report. This is the closest the trust fund has been to insolvency since 1997.

- The HI Trust Fund Faces a Large Shortfall. The Trustees project that HI spending will exceed revenue by $578 billion over the next decade. Over 75 years, they project a shortfall of 0.77 percent of payroll or 0.3 percent of Gross Domestic Product (GDP). This means that it would take about a 27 percent (0.77 percentage point) increase in the payroll tax rate or a 16 percent spending cut to ensure solvency.

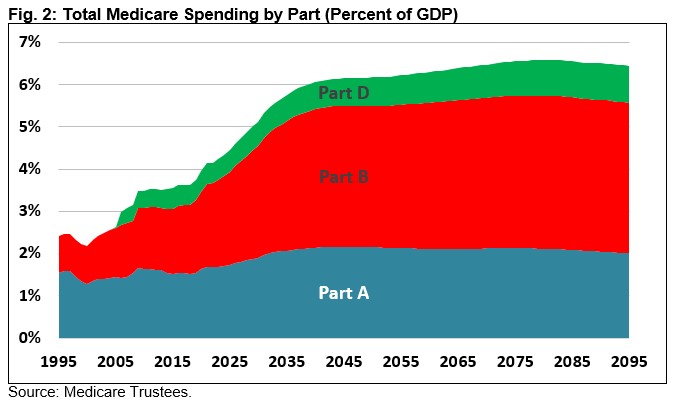

- Total Medicare Spending Is Projected to Grow Rapidly. The Trustees project that gross spending on Medicare Parts A, B, and D will grow from 4.1 percent of GDP in 2021 to above 6 percent by 2040 and stay at roughly 6.5 percent each year from 2070 onward.

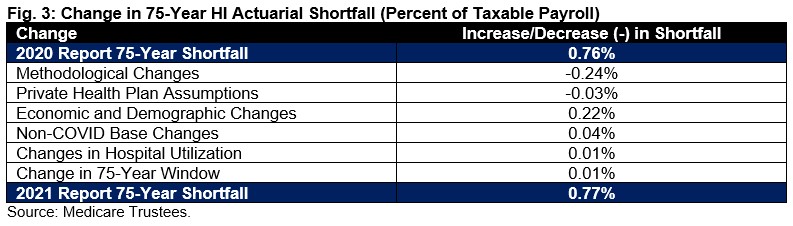

- Medicare’s Financial Outlook is Similar to Last Year. Despite the COVID-19 pandemic, the Trustees project few differences in the HI insolvency date, the 75-year shortfall, and overall Medicare costs.

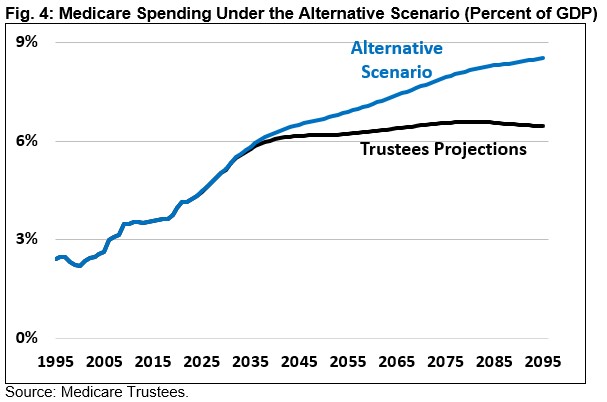

- Medicare’s Finances Would Be Worse Under an Alternative Scenario. The Medicare Chief Actuary produces an illustrative alternative scenario that assumes lawmakers update provider payment formulas over time so they remain sufficient to ensure continued Medicare beneficiary access. Under this scenario, total Medicare spending will grow to 8.5 percent of GDP in 2095 rather than 6.5 percent. The HI shortfall would be more than twice as large as the official projections at 1.61 percent of payroll.

The Trustees show that Medicare spending is projected to rise substantially and the HI trust fund is nearing insolvency. Health savings and trust fund solutions are needed to slow cost growth and ensure Medicare continues to pay full benefits.

The Hospital Insurance Trust Fund Will Be Insolvent in 2026

Medicare Part A, which pays for inpatient hospital services, is financed mostly from a payroll tax through the HI trust fund. Though the trust fund had a balance of $134 billion at the end of 2020, the Trustees expect it to run cash deficits in 2021 and every year after until it is exhausted in 2026, just five years from now. Upon insolvency, provider and insurer payments would have to be cut by 9 percent (up to 22 percent by 2045) to bring spending in line with revenue.

The HI trust fund has not been this close to projected insolvency since 1997, when depletion was projected to be just four years away. Later that year, lawmakers enacted a significant deficit reduction package that included Medicare cost reductions. Along with the strong late 1990s economy, this helped keep HI solvent into the 2010s.

Beyond 2026, HI faces a significant long-term shortfall. The trust fund will run deficits of $578 billion over the next decade (2022-2031), with annual deficits rising from 0.26 percent of taxable payroll in 2021 to 0.69 percent in 2031, 1.06 percent in 2043, and 0.42 percent by 2095. As a share of GDP, deficits will peak at 0.5 percent in 2043 and total 0.2 percent in 2095.

This imbalance is driven by growing spending due to rising health costs and an aging population. Specifically, HI spending will grow from 3.64 percent of payroll in 2021 to 4.34 percent by 2031, while revenue will grow more modestly from 3.38 percent of payroll to 3.65 percent.

Over 75 years, the HI trust fund faces an actuarial shortfall of 0.77 percent of payroll. Restoring solvency would require the equivalent of immediately raising HI revenues by 27 percent or reducing spending by 16 percent. Under the alternative scenario (discussed later), the shortfall and necessary adjustments would be nearly twice as large.

Total Medicare Spending Will Grow Significantly

According to the Medicare Trustees, all parts of Medicare – including Parts A, B, and D – will grow rapidly in the coming decades. The Trustees project that gross Medicare spending will grow from 4.1 percent of GDP in 2021 to 5.3 percent in 2031 and then to 6.2 percent in 2045. After reaching a high of 6.6 percent in 2080, their projection stabilizes and settles at 6.5 percent in 2095.

Medicare Part A, which covers HI benefits, will grow from 1.7 percent of GDP in 2021 to a high of 2.2 percent around 2045 and then settle down to 2.0 percent by 2095. The Trustees expect Part B (outpatient benefits) and Part D (drug benefits) spending to grow much more quickly. Over the next 75 years, they expect Part B to rise from 2.0 to 3.6 percent of GDP and Part D to rise from 0.5 to 0.9 percent of GDP.

This cost growth is driven in part by the rising cost of Medicare Advantage (MA), a private alternative to traditional Medicare that costs modestly more and has had increasing enrollment. As recently as 2010, only 25 percent of Medicare beneficiaries were in MA. Today, 43 percent are enrolled in MA, and by the early 2030s, the Trustees expect enrollment of over 50 percent. As a result, MA spending is expected to rise from 1.6 percent of GDP in 2021 to 2.4 percent by 2030.

This rapidly rising spending underscores the need for policies to reduce Medicare costs. Our Health Savers Initiative has proposed policies to equalize payments across sites of care, reduce Medicare Advantage payments, and reduce prescription drug costs. In addition, our ten options to secure the HI trust fund include five options that would reduce HI spending specifically as well as five options that would bring more revenue into the trust fund. Lawmakers would do well to use these options and countless others to slow the growth of Medicare spending.

Medicare’s Financial Outlook is Similar to Last Year

Overall, Medicare’s long-term financial outlook has changed very little relative to last year, despite the COVID-19 pandemic, recession, response, and recovery.

The Trustees now project gross Medicare cost of less than 6.1 percent of GDP by 2040, about 0.1 percent higher than in last year’s projections. By 2095, they project costs will total 6.5 percent of GDP, almost identical to last year’s projection.

In terms of the HI trust fund, the Trustees project the insolvency date will remain 2026, the same as they projected last year. They project the 75-year shortfall will total 0.77 percent of payroll, only slightly higher than last year’s 0.76 percent of payroll.

Lack of significant change in Medicare’s outlook is driven primarily by two offsetting effects. On the one hand, economic and demographic changes worsened the shortfall by 0.22 percent of payroll on net. This was primarily due to a projected decrease in taxable payroll and income as a result of the pandemic (though that is mitigated by a lower assumed payment rate through 2023).

On the other hand, methodologic changes – mainly to better estimate time-to-death for certain beneficiaries and enrollment in private insurance among those with end-stage renal disease – improved the outlook by 0.24 percent of payroll. Other factors made only a small difference.

There was an expectation earlier in the pandemic that COVID-19 would have a more negative effect on the HI insolvency date than this report shows. For example, early in the pandemic, the Congressional Budget Office revised its estimated insolvency date from 2026 to 2024.

However, a strong and rapid recovery in incomes and output – driven in part by an aggressive fiscal and monetary response – limited short-term revenue losses and increased revenue projections over the medium term. Meanwhile, the increased costs related to COVID-19 medical spending were mostly offset by a decrease in routine care and procedures, resulting in very little change in costs in the short term.

Medicare Will Grow More Costly in the Actuary’s Illustrative Alternative Scenario

The Medicare Trustees’ estimates are based on current law, which assumes that laws governing payment rates remain unchanged. However, the Trustees also raise questions about payment adequacy over the longer term, as both inpatient hospital payment and physician payments are scheduled to grow more slowly than underlying medical costs.

The Chief Actuary produces an illustrative alternative scenario that assumes the constraints under current law are gradually weakened and current bonus payment for physicians are extended. With these assumptions, payments would grow more slowly than in the private sector for the next two decades but then grow at about the same rate as the rest of the health care sector.

Under this scenario, spending would grow substantially higher than in the Trustees’ official forecasts, both for the HI trust fund and Medicare spending more broadly.

HI spending would rise from 1.7 percent of GDP in 2021 to 3.0 percent by 2095, as opposed to 2.0 percent under the official projections. As a result, the 75-year shortfall would total about 1.6 percent of payroll and 0.7 percent of GDP, more than double the official projections.

Medicare Part B spending would also grow faster under the alternative scenario, from 2.0 percent of GDP in 2021 to 4.6 percent in 2095 (compared to 3.6 percent in 2095 in the official projections).

As a result, total gross Medicare spending would continue to grow as a share of GDP over the very long term rather than stabilize around mid-century, rising from 4.1 percent of GDP in 2021 to 6.7 percent of GDP in 2050 (compared to 6.2 percent under the official estimates) and 8.5 percent in 2095 (compared to 6.5 percent under official estimates).

Conclusion

The Medicare Trustees’ report shows the HI trust fund will be insolvent by 2026 and Medicare spending will rise rapidly as a share of GDP over the next quarter-century. The illustrative alternative scenario that includes less restrictive payment policies shows Medicare spending rising even more substantially over the long term and the HI shortfall being about twice as large as under the official estimates. Under either scenario, action will be needed very soon to secure HI solvency and constrain the rising costs of Medicare.

It is particularly imperative that lawmakers act sooner rather than later to secure the Medicare HI trust fund by increasing revenues, reducing costs, or some combination. Without action in the next five years, Medicare payments from the trust fund would be abruptly and indiscriminately reduced or delayed, leading to a potential loss of access to care for enrollees.

Many options are available to secure and improve Medicare for future generations, and our Trust Funds Solutions Initiative and Health Savers Initiative will continue to put forward and analyze existing and new ideas to reduce Medicare costs and bring new funding into the program.

Along with the two Social Security trust funds and the Highway Trust Fund, all four major trust funds are headed for insolvency in the next 13 years. Securing these trust funds would prevent abrupt across-the-board benefits cuts, assure a more sustainable debt path, promote faster economic growth, and provide the opportunity to achieve a number of important policy goals.

You can read our analysis of the Social Security Trustees report here.

What's Next

-

Image

-

Image

-

Image