Will Falling Gas Prices Lead to a Long-Term Highway Solution?

Interest in increasing the gas tax appears to be heating up as policymakers realize the Highway Trust Fund is running on fumes, and an upcoming Fiscal Speed Bump offers the opportunity to change that. At the end of May, the latest highway bill will expire, and lawmakers will have to find a way to plug the $15 billion annual gap between highway spending and revenue.

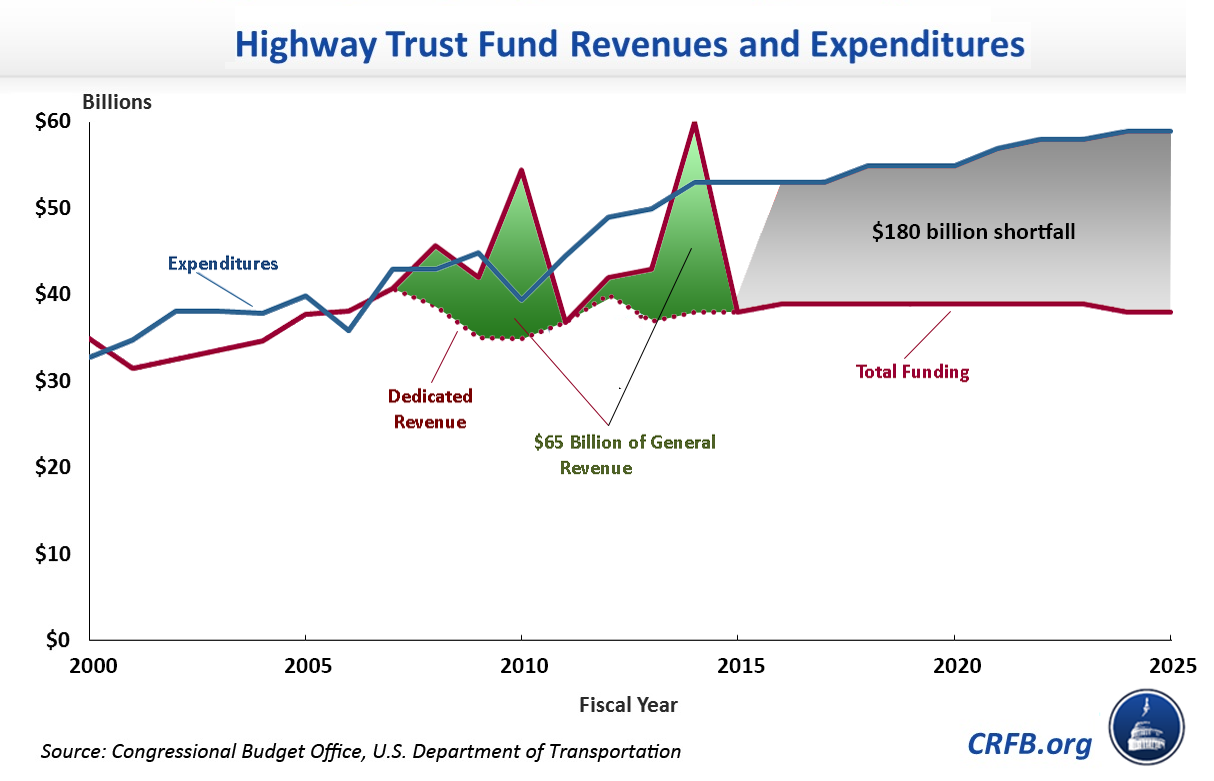

Over the next ten years, that gap will total $180 billion, and the practice of filling the difference with general revenue and budget gimmicks is becoming increasingly difficult. Highway spending has exceeded dedicated revenues for most of the past 15 years, and since 2008, lawmakers have transferred $65 billion from the general fund to the trust fund to cover its shortfalls rather than adjust highway spending or revenue.

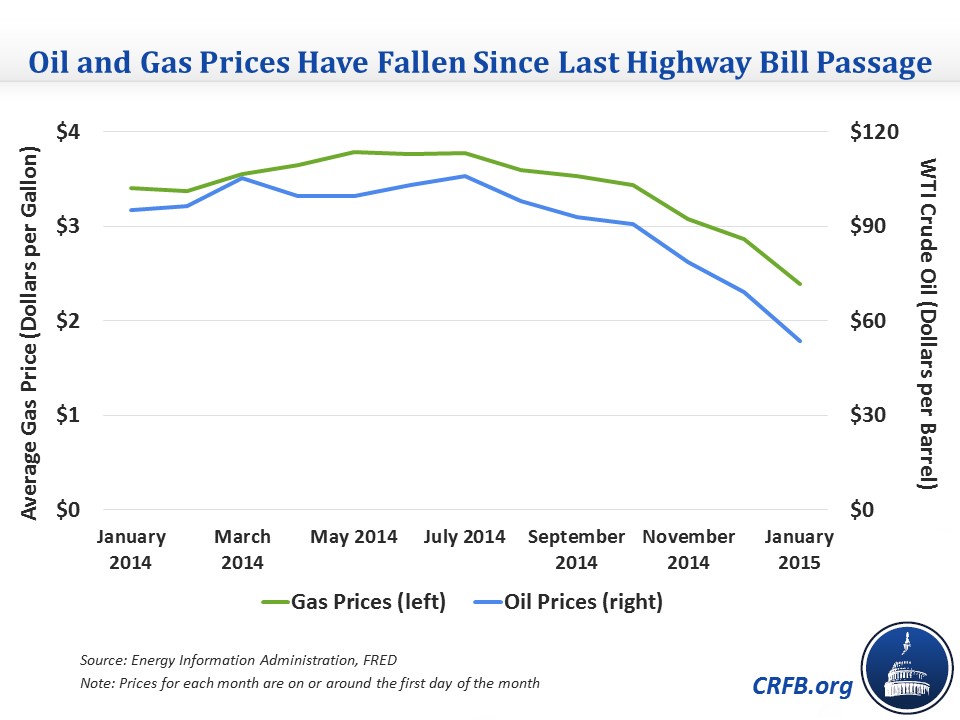

In the past, some policymakers have proposed raising the gas tax to close the gap structurally, but a major development may have made this possibility more likely: oil and gas prices plunging by more than half and two-fifths, respectively, leading to the lowest prices drivers have faced in six years. This plunge has led to speculation that the first gas tax increase in more than 20 years could now pass Congress (assuming the trend doesn't reverse in the next few months). For context, the 15 cent gas tax increase necessary to fully close the HTF shortfall is only one-tenth the size of the roughly $1.50 per gallon drop in gas prices.

In our paper on the Highway Trust Fund, we laid out a number of options for increasing fuel taxes and/or indexing them to inflation to ensure they don't lose purchasing power over time. In addition to those options, policymakers could also make fuel taxes more responsive to changes in gas prices, for example, by making the tax a percent of the price instead of a set amount (akin to a sales tax) or by having an "accordion tax," which increases when gas prices fall and decreases when prices rise. The downside of these policies is that inflows to the HTF would become less predictable, potentially leading to a sudden shortfall if revenue drops. These policies would also have advantages. The accordion tax, for instance, would bring greater stability for consumers.

While the landscape may not be wholly favorable for that to happen, there have been indications that an increase in the gas tax to cover some or all of the shortfall may be becoming more viable. This week, Sen. Dick Durbin (D-IL) and House Minority Leader Nancy Pelosi (D-CA) announced their support for a gas tax increase, and several Senate Republicans have made comments suggesting openness to the idea as well.

Of course, raising fuel taxes is not the only way to deal with the HTF shortfall. Policymakers could also reduce spending by making targeted cuts to programs contained in the highway bill or by mandating a broad freeze on spending. They could also introduce new revenue sources related to infrastructure, including new fees on vehicles and freight or the much-discussed vehicle miles traveled (VMT) tax. Alternatively, there are plenty of options -- many related to transportation -- to finance a general revenue transfer if that is needed in the short term. In our paper on the Highway Trust Fund and reauthorization bill, we outlined a number of options for increasing fuel taxes and other dedicated revenue sources as well as options for reducing spending.

Options for Savings Within the Highway Trust Fund

Source: CBO, National Surface Transportation Infrastructure Financing Commission, and CRFB calculations

Note: Numbers do not take into account most recent highway bill

Hopefully, 2015 is the year when lawmakers fix the HTF's financing issue to bring spending and revenues in line and put them on a sustainable long term course. Lawmakers should get moving to address this and the other fiscal speed bumps they will face in the first half of this year.