Warning Shots for Lawmakers on the Debt

Today, the credit rating agency Moody’s made it clear that it is unlikely that the U.S. will be able to maintain its Aaa rating unless a comprehensive budget deal is reached. According to Moody’s, the only way the U.S. would be able to keep its current rating for sure would be to enact a plan that put debt as a percent of GDP on a downward path. Even the fiscal cliff scenario, which would do that at the expense of likely causing a recession, would not necessarily ensure a Aaa rating because of the economic damage.

Moody's views the maintenance of the Aaa with a negative outlook into 2014 as unlikely. The only scenario that would likely lead to its temporary maintenance would be if the method adopted to achieve debt stabilization involved a large, immediate fiscal shock—such as would occur if the so-called "fiscal cliff" actually materialized—which could lead to instability. Moody's would then need evidence that the economy could rebound from the shock before it would consider returning to a stable outlook.

Like us, Moody’s recognizes that the only positive way out of our debt mess is to put in place a smart, comprehensive debt reduction plan that stabilizes the debt and eventually puts it on a downward path as a share of the economy. However, it is notable that based on their statements, they view the cliff scenario as preferable to the "mountain of debt" scenario, since they would certainly downgrade the U.S. in the latter situation. That's the message we've been stressing for months! (see here, here, here, and here).

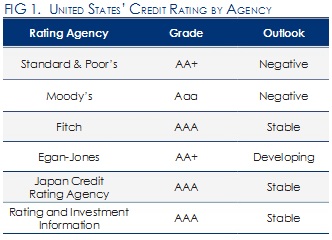

As a reminder, here is where the U.S. stands with the three major ratings agencies and a few others (table taken from our report on the S&P downgrade of U.S. debt).

And Moody's isn’t the only one expressing concern about how lawmakers decide to handle the end of the year mess. German Finance Minister Wolfgang Schaeuble questioned on Tuesday how the United States would deal with its high levels of government debt after November's presidential election. According to Reuters and CNBC:

Schaeuble said worries about U.S. debt were a burden for the global economy, hitting back at Washington which has criticized Europe for failing to get a grip on its own debt crisis. In private, German officials often express concern about U.S. debt levels and the inability of politicians there to reach a consensus on how to reduce it, but Schaeuble's public remarks underscore the extent of the worries in Germany."

If it wasn't already clear, there is a lot at stake in the next three months. How lawmakers deal with the fiscal cliff will be key to our economic future. All eyes will be on Washington, so they must get it right.