Waiting To Reduce Debt Makes It More Difficult

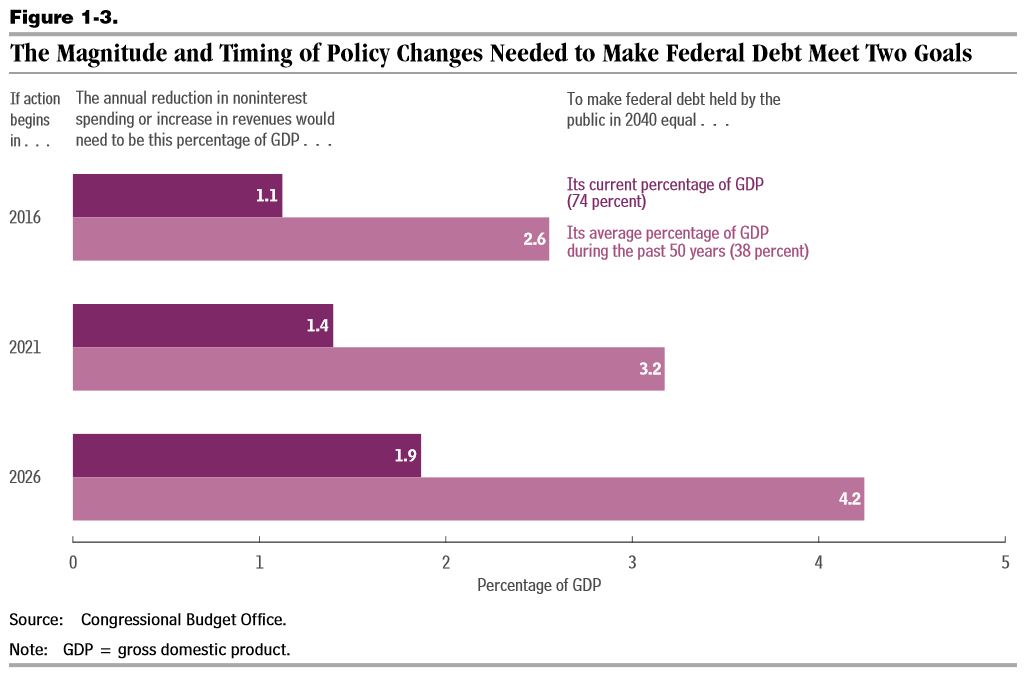

In their recently released long-term outlook, the Congressional Budget Office (CBO) laid out multiple scenarios for addressing our unsustainable long-term debt path. They show that it would take a long-term deficit reduction path that would include about $2.6 trillion of deficit reduction over the first 10 years to stabilize the debt at current levels, or about 1.1 percent of GDP per year. However, waiting even 5 years to start would necessitate a reduction of 1.4 percent per year. In other words, stabilizing our debt over 25 years will cost another $850 billion if we wait 5 years instead of acting today.

CBO explains why costs increase with delay:

The sooner significant deficit reduction was implemented, the smaller the government’s accumulated debt would be, the smaller the policy changes would need to be to achieve a particular long-term outcome, and the less uncertainty there would be about what policies would be adopted.

Delaying the start of deficit reduction makes the goals of stabilizing the debt and putting it on a downward path much more difficult.

Quantifying the cost of waiting can be done by estimating the fiscal gap, or the amount of non-interest spending and revenue changes necessary to keep debt stable (or reduce it to some other level) over a period of time. Focusing on the 25-year fiscal gap, CBO shows that keeping the debt stable would require a reduction in non-interest spending and/or an increase in revenues of 1.1 percent of GDP (as indicated above), while reducing the debt to its 50-year historical average share of 38 percent of GDP would require revenue increases and/or spending cuts equal to 2.6 percent of GDP (a path of deficit reduction nearly $6 trillion over the first ten years alone). These figures assume that changes are implemented today and grow considerably larger if policymakers wait five or ten years to take action.

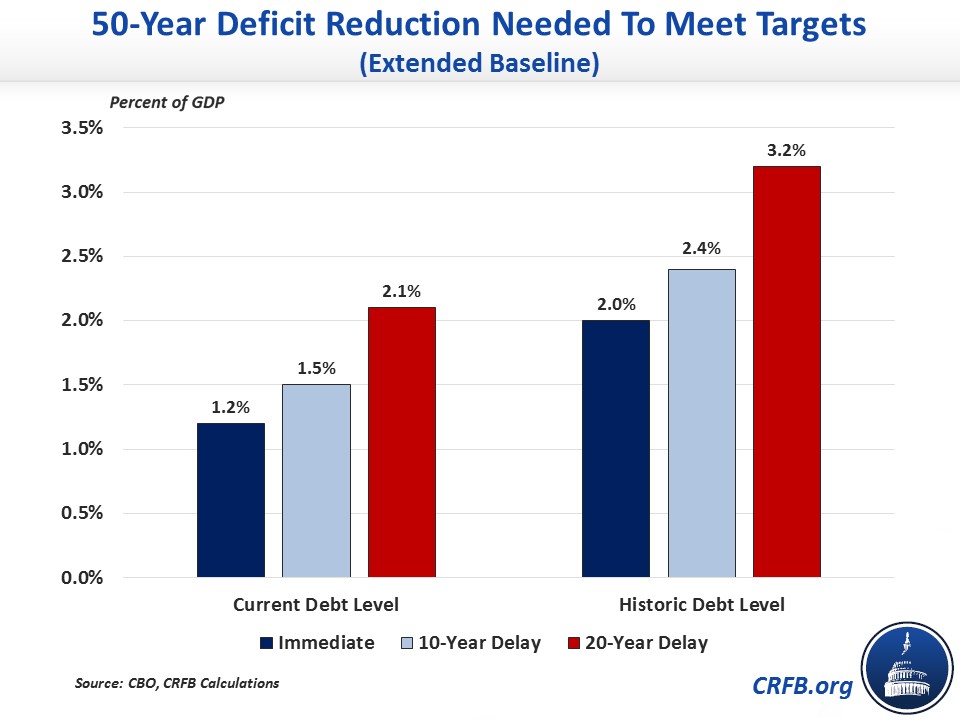

Stretching out the timeframe to 50 years, rather than 25, reveals a similar story. By our estimates, keeping debt at its current level or reducing it to the historical share of GDP 50 years from now would require annual deficit reduction of 1.3 and 1.9 percent of GDP, respectively. Waiting 10 years to act would increase those totals to 1.6 and 2.4 percent, while a 20-year delay would push them up to 2.1 and 3.2 percent.

But even these numbers could underestimate the costs of actually implementing this level of fiscal responsibility. Policymakers would likely want to phase in changes over time even after they decide to take action. In practice, gradually phasing in changes will not have as large of an immediate impact, so larger changes may be needed.

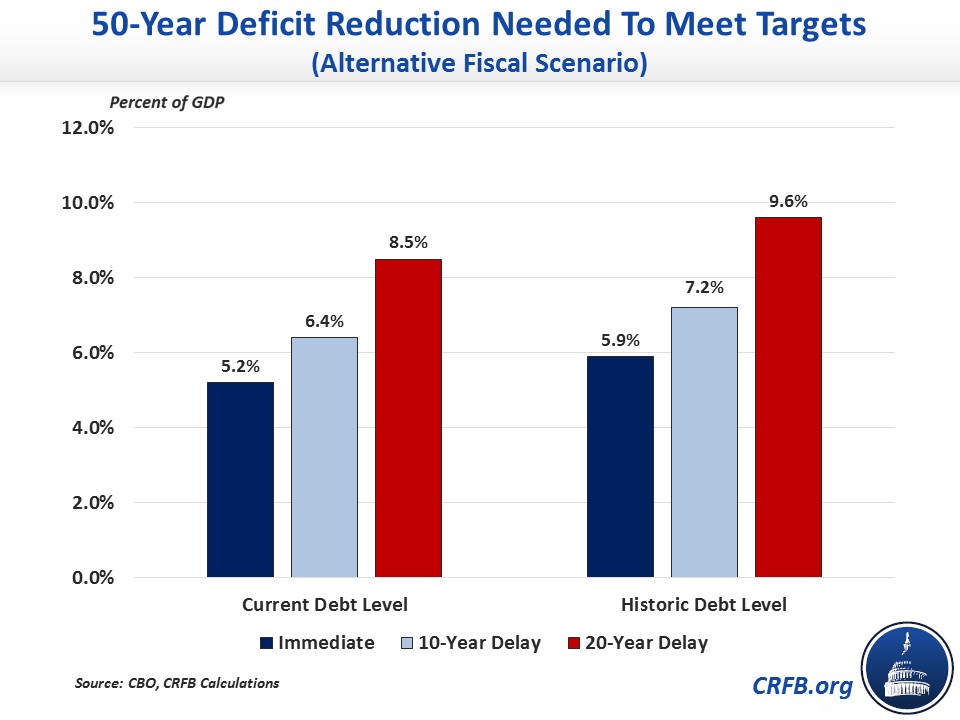

Finally, all of these calculations assume that policymakers do nothing to make the debt situation worse. When we compare the costs of putting debt on either a stable or downward path to CBO's alternative fiscal scenario (which assumes Congress cuts taxes and increases spending more than in current law), the deficit reduction required and the corresponding costs of delay are unsurprisingly much larger.

It is clear that policymakers need to enact a plan to control our unsustainable long-term debt path. While cutting spending or raising revenue does not need to happen immediately, this doesn't eliminate the need to begin crafting a long-term plan. Acting sooner will reduce the size of the necessary adjustments and allow for a longer phase-in period, giving both individuals and businesses time to adjust. CBO's analysis is very clear that the longer we delay, the more severe and abrupt deficit reduction will be required.

This blog is part of a series examining aspects of CBO's 2015 Long-Term Budget Outlook. Click here to read our 6-page summary of CBO's paper, or here for other blogs in the series.

This blog was updated on 6/30 to correct a typo in the second chart