Update: Why Our Debt Is Still a Problem Even if Deficits Fall

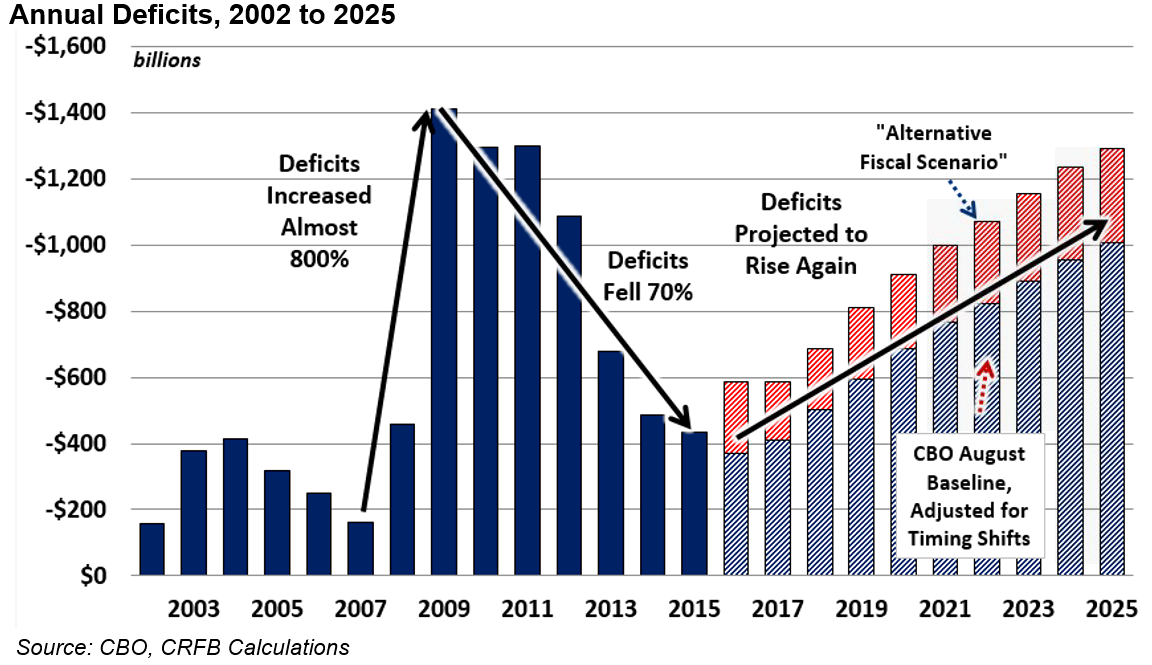

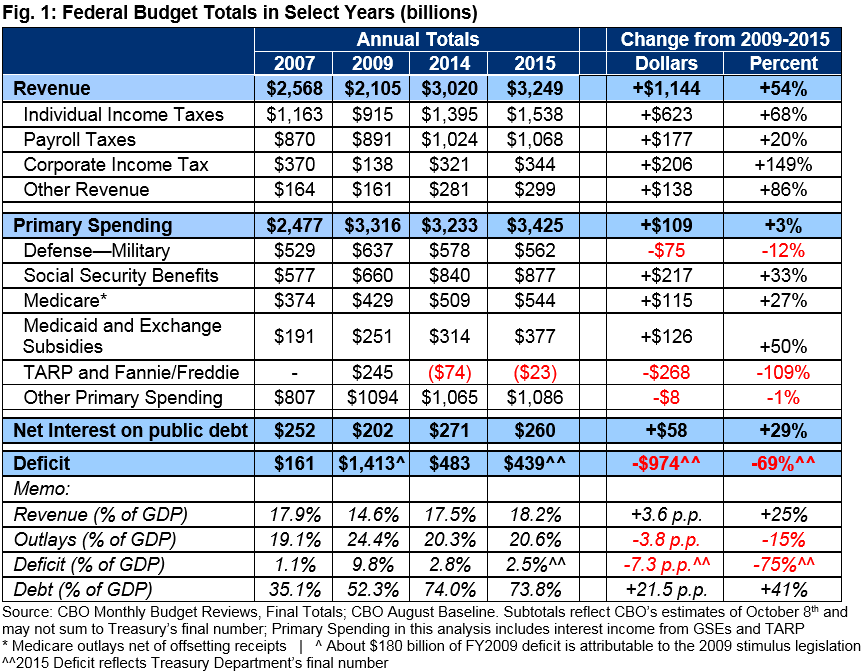

September 30th marked the end of the Fiscal Year, and the final numbers are in. The deficit for last year was $439 billion, according to the final report by the Treasury Department (a previous estimate from the Congressional Budget Office (CBO) had projected the deficit at $435 billion). We've released a short paper FY 2015 Deficit Falls to $439 Billion, but Debt Continues to Rise that shows even though this is roughly 10 percent below the FY 2014 deficit and nearly 70 percent ($439 billion) below its 2009 peak ($1.4 trillion), the country remains on an unsustainable fiscal path.

Click here to read the full paper

The decline in deficits from 2009 to 2015 was largely expected as a result of the recovering economy and the fading of measures intended to boost the recovery. While legislated spending reductions, tax increases, and other factors have played a role in reducing short-term deficits, the long-term challenge is still largely unaddressed: growing mandatory spending and relatively flat revenue are projected to cause deficits and debt to rise over the next decade and beyond, with trillion-dollar deficits returning by 2025, if not sooner.

The fall in deficits can largely be explained by a 54 percent ($1.1 trillion) increase in revenue, while primary spending has only increased by 3 percent. Spending has increased in dollar terms on Social Security, Medicare, and Medicaid, while defense spending has fallen and the total of other spending has remained virtually flat.

The full paper includes additional graphs about future debt levels, which are projected to exceed the size of the economy by 2040, or 2031 if lawmakers do not pay for the costs of spending increases and tax cuts.

As we conclude:

Policymakers must work together on serious tax and entitlement reforms to put debt on a clear downward path relative to the economy, and should not declare false victories while sweeping the debt issue under the rug.

Click here to read the full paper