The True Cost of Federal Credit Programs?

In a new report released yesterday, the Congressional Budget Office looked at the difference in accounting methods used to score federal credit programs. This was a follow up to a previous report which we analyzed back in March about how the costs of federal loan and loan guarantee programs would look if we changed the way we accounted for them.

To recap, under current rules enacted in the Federal Credit Reform Act of 1990 (FCRA), the lifetime cost of federal direct loans and loan guarantees are shown in the year that the loan is made on an accrual basis unlike most other items in the budget. All future costs and interest repayments associated with the loan are discounted to the present using interest rates on Treasury debt with a duration that matches the underlying loan. These estimates do not reflect the cost of market risk which the government is exposed to through loans and loan guarantees (although the probability of default by borrowers is accounted for). Another method that has recently gained attention is the "fair-value" approach, which would measure these programs’ costs at market prices by applying discount rates on expected future cash flows that private financial institutions would apply (i.e. higher rates than those on Treasury bills). It should be noted, however, that some federal programs already incorporate fair-value accounting, including payments to the IMF and the Troubled Asset Relief Program.

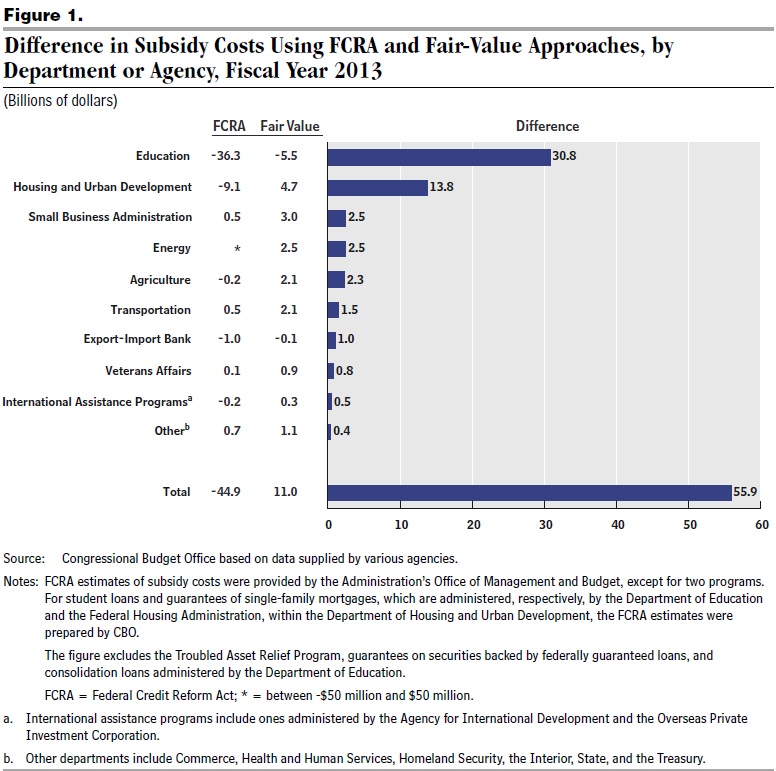

Looking at 2013 alone, CBO finds that expected new loans and loan guarantees in the amount of $635 billion will reduce the deficit by $45 billion over their lifetime using current FCRA standards. However, if fair-value accounting was employed for the same year, the loans and loan guarantees would have a lifetime cost of $11 billion. Other highlights of the report include:

- Fair-value subsidy rates are about 9 percent higher than FCRA subsidy rates because the annual market risk premium is added to the corresponding return on Treasury securities.

- 33 of the 38 discretionary credit programs CBO examined increase the deficit under the fair-value approach, whereas they reduce the deficit using FCRA procedures.

- Some fair-value estimates still show net savings, such as federal student loan programs which reduces the deficit by $5.5 billion in 2013 (compared to a reduction of $36.3 billion under FCRA).

While several proposals to use fair-value accounting have been proposed in Congress (most recently passing the House), there still remains some contention over using this method. Opponents have argued that using market-based rates for discounting loan repayments to the government is inappropriate because the federal government can fund loans using Treasury debt with little to no market risk. However, CBO contends if taxpayers were to finance such loans as private investors, they would use discount rates that account for market risk. CBO does admit there are several challenges to fair-value estimating, such as additional expenses needed to train staff in government agencies, volatility over time due to market conditions, and judgments about discount rates leading to inconsistency.

Overall, this report gives us a deeper look into understanding the true costs for some federal credit programs. Providing policymakers with more accurate budgetary analysis is important as they consider spending proposals and choose between credit assistance and other forms of federal aid. This is especially timely as Congress currently considers whether to extend a 3.4 percent interest rate extension on Stafford loans set to expire on Sunday.