Tax Deal Goes Beyond Simple Extensions

Congress is in the process of negotiating a potential $700 billion deal that would extend several tax provisions that expired at the end of 2014 known as tax extenders. The deal could cost up to $840 billion over ten years when interest costs are included. However, that deal would go beyond what typical year-end tax extenders bills do. Rather than simply reviving expired tax breaks, the deal would reportedly also expand some of these provisions, create new policies, and include policy riders unrelated to expired tax provisions that will increase the bill's cost by one-sixth, or about $110 billion.

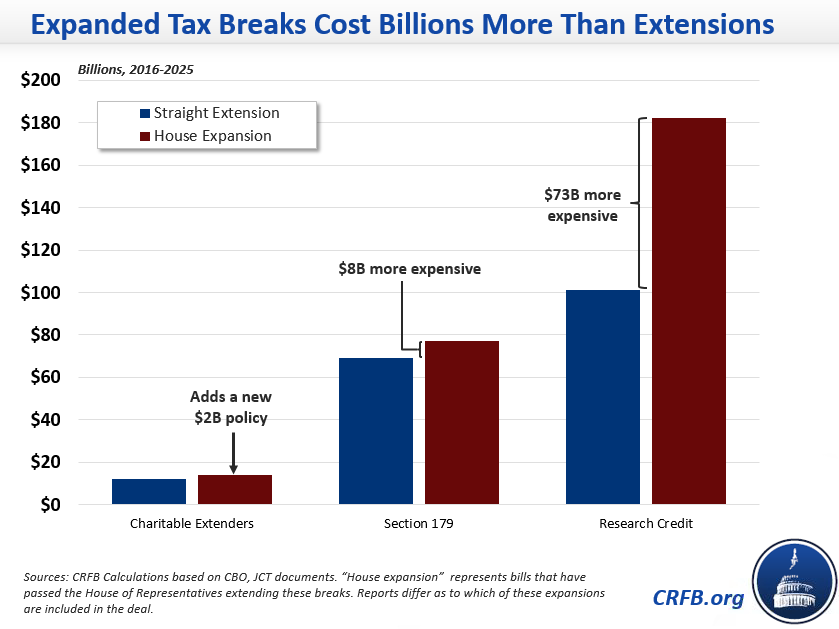

While the deal is being developed, the precise contours of the deal remain unknown, but there are some indications in the press what it could include. For instance, a permanently extended research credit would cost $109 billion over the next ten years, according to the Joint Committee on Taxation. Yet, an expanded – and more expensive – version of the research credit passed by the House at a cost of $182 billion is rumored to be included in the deal.

House-passed legislation appears to be the model for expanded tax breaks in this deal. For example, one House bill indexes to inflation a provision that increases the amount of capital investments a small business can deduct immediately, and another creates a new policy that lowers the excise tax paid by private foundations. The extenders deal also reportedly includes provisions unrelated to the expiring provisions: a two-year delay of the "Cadillac tax" on high-cost health insurance plans, a two-year delay of the medical device tax, and additional funding for insurers in the health exchanges who insure higher-cost patients.

All told, these add-ons and expansions may add to $110 billion to the cost of bill. Press reports suggest that further expansions might also be on the table, such as indexing to inflation the Child Tax Credit and the American Opportunity Tax Credit for attending college. Those two changes might add between $70 and $90 billion to the bill's total cost.

Expansions in the Reported Deal

| Policy | Extending Current Policy | Being Considered | Additional Costs |

| Extend and Expand Research Credit | $109 billion | $182 billion | $73 billion |

| Continue and Index Section 179 to Inflation* | $69 billion | $77 billion | $8 billion |

| Extend and Expand Charitable Tax Breaks | $12 billion | $14 billion | $2 billion |

| Delay Medical Device Tax for Two Years | - | ~$5 billion | ~$5 billion |

| Delay Cadillac Tax for Two Years | - | ~$15 billion | ~$15 billion |

| Provide Additional Funding for ACA Risk Corridors | - | ~$5 billion | ~$5 billion |

| Provisions Not Being Expanded | ~$400 billion | ~$400 billion | |

| Subtotal | ~$590 billion | ~$700 billion | ~$110 billion |

Source: CRFB calculations, JCT, CBO, press reports. Based on reports of the contents of the deal.

*Press reports aren’t clear whether the deal includes the $8 billion House expansion, but it is assumed here.

The Senate Finance Committee took a somewhat less irresponsible approach to tax extenders. In addition to only extending expired tax breaks for two years, the tax extenders legislation reported by the Senate Finance Committee included offsets to pay for modest expansions of existing tax breaks. This principle of offsetting costs above current policy is consistent with the approach Congress took in the deal replacing the Medicare Sustainable Growth Rate earlier this year and would impose at least some discipline on the process.

Some critics are saying that the tax extenders would have never been paid for anyway, so permanently extending them does not really increase the deficit. This business-as-usual rationale is one reason we've ended up with record-high debt levels that are projected to continue growing unsustainably. Moreover, the decision to permanently extend tax breaks without offsetting the costs opens the door to including additional costs for expanding tax breaks and adding new tax breaks without offsetting those costs either. The $110 billion in new or expanded policies would cost more than all the legislation that added to the debt last year and rank as this year's second-costliest bill, behind the partially unpaid-for SGR reform bill earlier this spring that cost $141 billion before interest.

The cost of the $700 billion deal will be added to the deficit because lawmakers aren't willing to find offsets elsewhere in the tax code or budget, as we suggested in the PREP Plan. Requiring offsets forces legislators to make tough choices about tradeoffs and set priorities. By contrast, abandoning this principle opens up the process to new or expanded policies being added, as we are seeing with this costly package.

Further Reading:

Update: 12/2/15 We've corrected the table for a mathematical error. A straight extension of the research credit is estimated by the Joint Committee on Taxation to raise $109 billion (as the post says in the text), not $101 billion (as previously in the table). As a result, the sum of the bill's expansions now rounds to $110 billion instead of $120 billion. As a reminder, all these numbers are extremely rough because we don't know the exact contents of the deal.