SSDI Solutions Initiative Releases Issue Brief on the Financial State of the Program

The McCrery-Pomeroy SSDI Solutions Initiative newly released an issue brief on the financial state of the SSDI program, the third primer in its series on the Social Security Disability Insurance (SSDI) program. After the 2015 Social Security Trustees' Report, more attention has focused on the upcoming shortfall in SSDI funding at the end of 2016 when the program will only be able to pay out 81 percent of scheduled benefits with the payroll tax revenue it receives. This is one of the Fiscal Speed Bumps that lawmakers will need to navigate by the end of the 114th Congress.

The brief examines how SSDI is funded, analyzes the short-term funding gap facing the program, and explores the long-term funding challenges due to the evolving composition of the SSDI program. While there is an immediate funding need through the next few years, there is also a long-term shortfall that parallels the situation facing its Old-Age and Survivors' Insurance counterpart: insufficient revenues to pay out scheduled benefits.

Below is an excerpt from the brief:

Source of Revenue and Spending in the SSDI Program

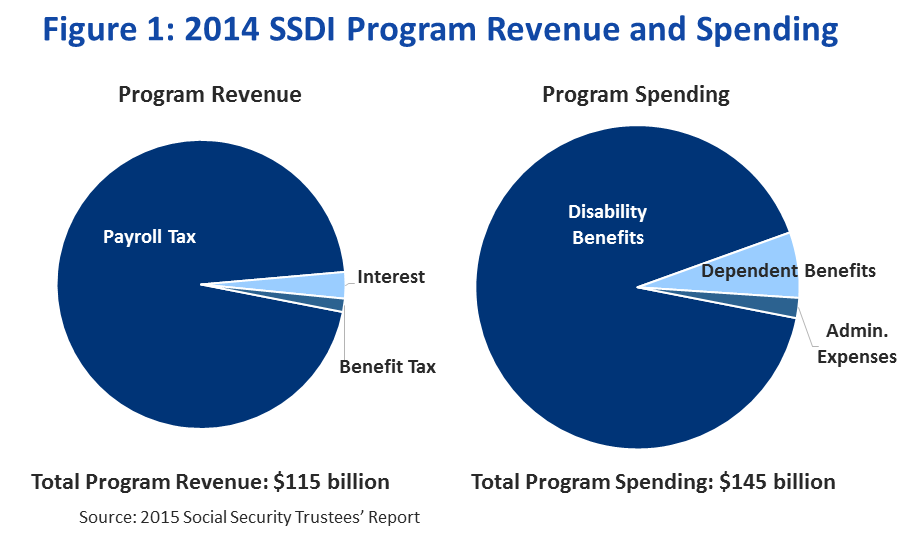

The Social Security Disability Insurance (SSDI) program is largely a self-funded, pay-as-you-go program which funds current benefits with tax revenue from current workers. Revenue for the program comes primarily from a 1.8 percent payroll tax on a worker’s first $118,500 in earnings (indexed to average wage growth) – 0.9 percent is paid each by the employee and employer. These funds, along with a small amount of money from the partial income-taxation of benefits and interest on trust fund assets, are used to pay benefits to workers with disabilities and their dependents and fund the program’s modest administrative costs.

The Short-Term Financial Outlook of the SSDI Program

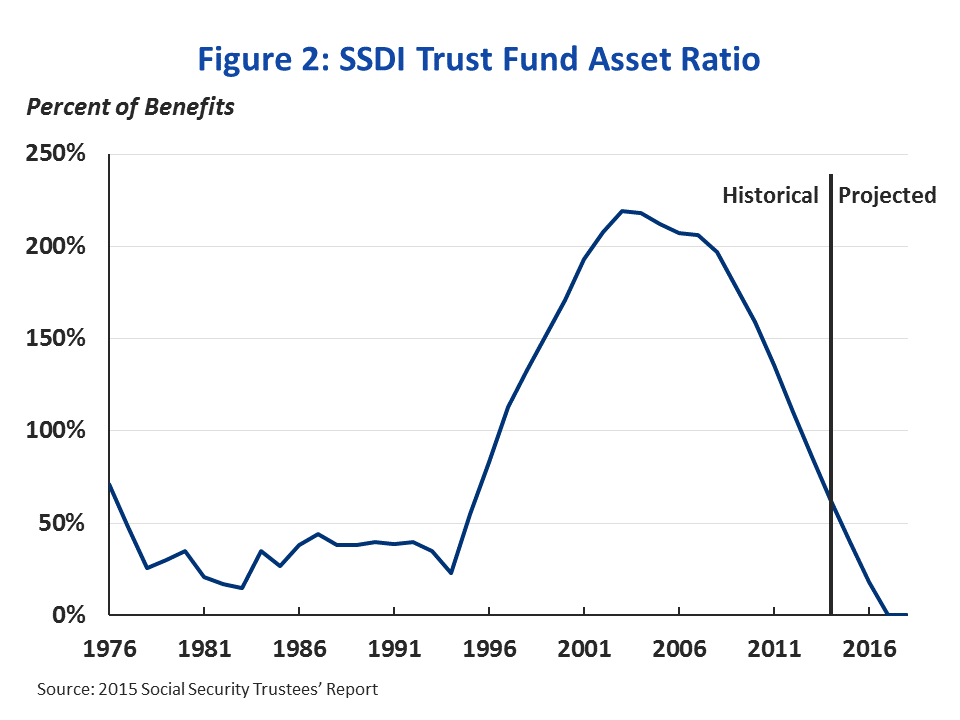

Since 2005, the SSDI program has incurred more costs than it has raised in revenue, forcing it to drawdown its trust fund reserves. In 2014, for example, the SSDI program spent $145 billion while raising only $110 billion in tax revenue.

As a result of this imbalance, the Social Security Trustees expect the SSDI trust fund reserves to be depleted by the end of 2016 under current law. As a result, only 81 percent of benefits would be payable without Congressional action to avoid this depletion.

Click here to read the rest of this issue brief, which describes the rest of this issue in detail.

The McCrery-Pomeroy SSDI Solutions Initiative is a project dedicated to identifying practical policy changes to improve the Social Security Disability Insurance (SSDI) program and other services for people with disabilities. With the SSDI trust fund only a little over a year from depleting its reserves, these solutions can help spur a debate on how to ensure the SSDI program best serves workers with disabilities, those who pay into the program, and the economy more broadly.

The project was launched this past September by former Congressmen Jim McCrery (R-LA) and Earl Pomeroy (D-ND) in coordination with the Committee for a Responsible Federal Budget. The congressmen co-chaired the SSDI Solutions Conference on August 4, 2015, featuring 12 commissioned papers with presentations from their authors. Hopefully, these papers will catalyze a serious discussion about how to improve the program for those who depend on it and address the program’s funding shortfall well before the Disability Insurance trust fund depletes its reserves in late 2016.

Click here to learn more about the SSDI Solutions Initiative and here to read the third issue brief on the financial state of the SSDI program