Shoring Up Trust Funds Greatly Improves Debt

The main focus of CBO's long-term budget outlook is rightly on the unified budget numbers regarding spending, revenue, deficits, and debt. But it is also important to look at trust funds, both in what CBO estimates for their insolvency date and how CBO's assumptions about trust funds can affect debt.

CBO's ten-year projections also project insolvency dates for three trust funds: the Highway Trust Fund (later this summer), the Social Security Disability Insurance (SSDI) trust fund (FY 2017), and the Pension Benefit Guaranty Corporation's (PBGC) multiemployer pension fund (FY 2024). The PBGC's trust fund exhaustion is reflected in the budget numbers, meaning that spending is automatically limited to incoming revenue, but the other two much larger trust funds are assumed to continue spending at scheduled levels despite not having the resources to do so.

The same goes for the two trust funds whose exhaustion dates will come after ten years and thus are only discussed in the long-term outlook: the Medicare Hospital Insurance (HI) trust fund and the Social Security Old Age and Survivors' Insurance (OASI) trust fund. CBO does not specifically project an insolvency date for HI, which finances Part A of Medicare, because it doesn't do long-term projections for each part of Medicare. It does say that exhaustion would likely come shortly after ten years, and by the looks of the ten-year projections, that date would likely be around 2027.

As for OASI, CBO projects the trust fund to run out in 2031, the same as it projected last year. But on a combined basis, the Social Security trust funds would be depleted in 2029, one year earlier than CBO projected last year.

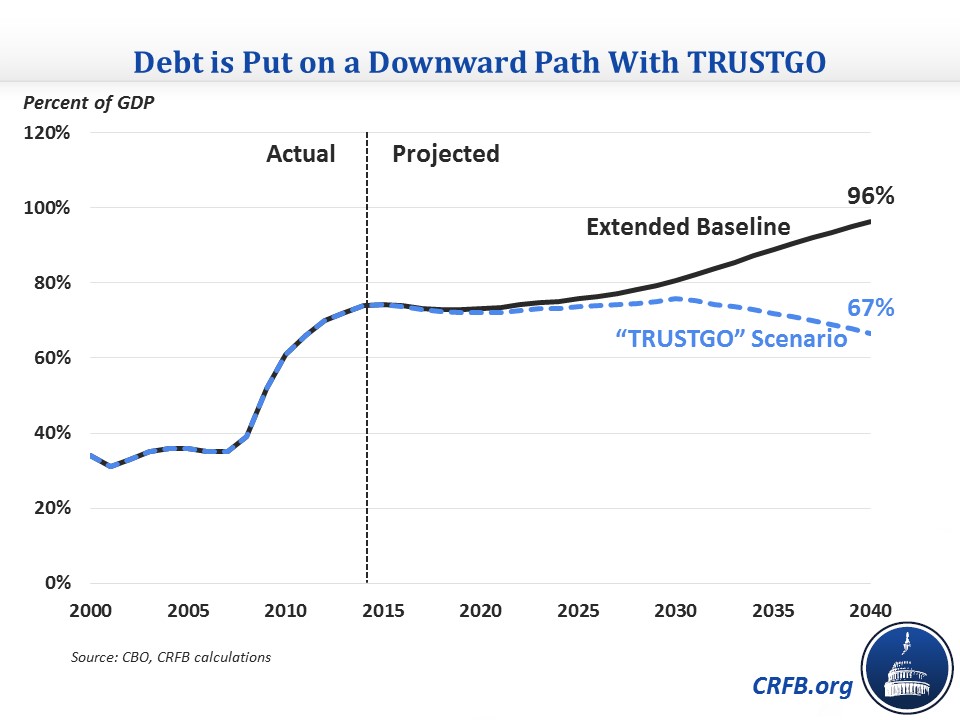

These insolvency dates, coming up within fifteen years, should be calls to action to fix each program's finances. But notably, doing just that would also improve CBO's debt numbers since they assume that programs will operate as scheduled regardless of the state of their trust funds. Thus, abiding by "TRUSTGO," or ensuring that trust funds are fully financed, would make a big difference in debt. It would rise from 74 percent in 2015 to a peak of 76 percent of GDP by 2030, before declining to 67 percent by 2040 and lower thereafter, a clear improvement on the continuous upward trajectory of current law.

Of course, shoring up these trust funds would not be an easy task and would require the type of significant entitlement and/or tax reforms that lawmakers have so far been unwilling to take up. But doing so would clearly make the long-term picture much brighter.

This blog is part of a series examining aspects of CBO's 2015 Long-Term Budget Outlook. Click here to read our 6-page summary of CBO's paper, or here for other blogs in the series.