Senate Moves Forward on Increasing Deficit with Tax Extenders

The Senate is moving forward with tax extenders legislation, renewing a variety of breaks that expired at the end of last year for research, small business, and wind energy, among other provisions.

According to press reports, Senator Tom Coburn (R-OK), one of three who voted against considering this legislation, will raise a budget point of order against the bill. The bill would increase the deficit by $84 billion by extending nearly all of the tax breaks that expired last year, with added breaks for start-up research expenses, bike-share commuting, and theater performances. While a budget point of order does not make the bill any more difficult to pass (it takes 60 votes to overcome a point of order, the same needed for the procedure to pass legislation), it will make Senators take a separate vote on increasing the deficit to pay for these tax cuts.

The bill violates two separate budget enforcement rules. First, it reduces tax revenue below the current law levels called for in the Murray-Ryan agreement serving as this year's budget. While the Murray-Ryan agreement did not call for increased revenues as the Senate's FY 2014 budget resolution did, it maintained revenues at current law levels, effectively assuming expired tax breaks would be paid for if renewed. Second, the legislation violates the Senate's pay-as-you-go rule by increasing the deficit both this year and over the next decade.

The House is taking a different, but still irresponsible, approach by selecting certain provisions to extend permanently, adding $310 billion to the deficit. The House already approved a $156 billion extension and expansion of the research and experimentation credit and will likely consider more breaks in the coming weeks.

Some of these tax provisions are certainly worth keeping, but they should be paid for. However, neither side of Congress appears willing to stand up for fiscal responsibility. If the bill remains unpaid for, here are some of the problems that will result:

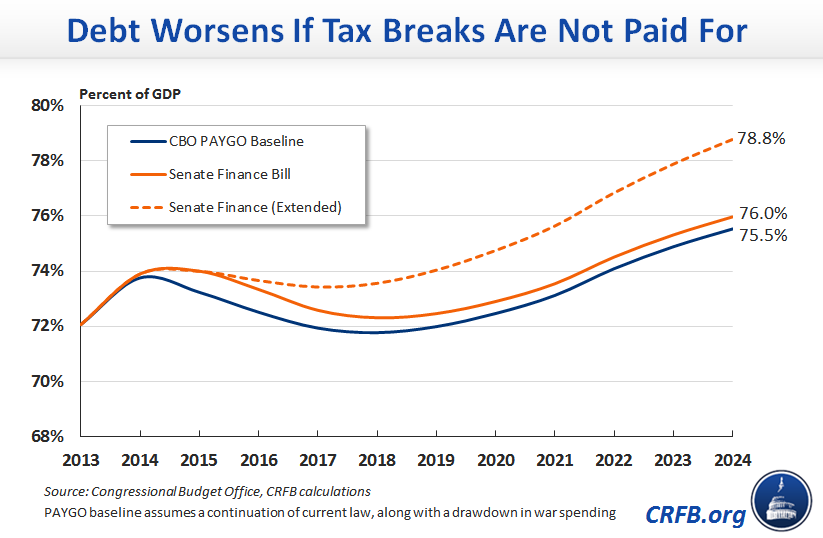

- Increases an already unsustainable debt. The Senate bill would cost $84 billion over ten years but, more importantly, continues an ignoble tradition of continuing these breaks without offsets. If all the provisions in the Senate Finance bill are extended permanently, they will cost about $700 billion, causing debt to rise to nearly 79 percent of GDP by 2024.

- Squanders all the new revenue from the fiscal cliff deal. The fiscal cliff deal at the beginning of 2013 raised some revenue for deficit reduction from the top 1 percent of earners. However, if Congress extends these tax breaks, it will give away nearly all of this revenue, largely for business tax breaks. Including interest costs and the past extensions, a permanent continuation of these provisions would cost almost $1 trillion, nearly the same amount scheduled to be raised from high-earners between 2013 and 2024.

- Violates budget enforcement rules. As mentioned above, the bill violates two separate budget provisions. First, it reduces tax revenue below the current law levels called for in the Murray-Ryan agreement. Secondly, it violates the Senate pay-as-you-go rule by increasing the deficit both this year and over the next decade.

- Contrary to all six proposed budgets this year. Failing to offset the cost of the extenders would run contrary to all six proposed budgets this year, including the House-passed Republican budget and the Murray-Ryan budget agreement, which functionally serves as this year's budget in each chamber. Each budget calls for revenues at or above CBO's current law baseline, implicitly assuming that all temporary tax breaks are either allowed to expire or are offset with other revenue increases.

- Lowers the baseline for tax reform. Various tax reform plans have been either revenue-neutral or revenue-positive, raising more money for deficit reduction. For example, the tax reform proposal put forward by Ways and Means Committee Chairman Dave Camp (R-MI) was revenue-neutral relative to current law, effectively requiring offsets for extending any expired tax cuts. Although the Senate bill would extend the expired tax breaks for only two years, some Senators have suggested these breaks should be extended so they are available to eliminate during tax reform. Passing the tax extenders now without offsets could present the opportunity for tax reform to be measured against the lower revenues in a "current policy" baseline which assumed the extenders continue after 2015. As a result, future "revenue-neutral tax reform" would represent a tax cut from current law levels or tax reform which raised revenue might still be below current law levels. A section of the bill states that Committee leaders should consult "so as to ensure that an appropriate baseline is used during tax reform." If tax reform uses an alternative baseline which assumes the continuation of all tax extenders, this Senate bill could lower the bar for future tax reform by $700 billion.

- Masks individual provisions. The Senate bill would extend 56 separate provisions of the tax code as one package, eliminating the scrutiny on individual tax provisions. For instance, Senator Lamer Alexander (R-TN) has argued to eliminate the wind production tax credit and Chairman Camp eliminated approximately 30 of the extenders in his tax reform discussion draft. However, voting for all the extenders as a package does not give Congress the opportunity to consider the individual provisions.

- Amendments could turn into a spending free-for-all. When legislation is not subject to any budget discipline, the amendment process (if there is one), can turn quickly turn into a spending spree, as it did for the amendments offered in the Senate Finance Committee which restored almost every expired tax break. Senate Republicans are proposing an amendment that would repeal the medical device tax, costing an additional $30 billion. The House bill also attracted a number of amendments that would have permanently extended other expired tax breaks.

- Offsets are possible. If Congress wanted to responsibly pay for the extenders, it wouldn't be that difficult. As an example, we put together a list of commonly discussed offsets, including a few that have been proposed by both Chairman Camp and President Obama.

Proponents of passing the tax cuts without offsets argue that the extenders do not need to be paid for, because Congress has routinely passed them in the past without offsets. However, this fiscally irresponsible practice has contributed to the current record-high levels of debt. These proponents also state that extending current policy does not require offsets, which is budgetary slight-of-hand that makes costs disappear from the budget process. These tax cuts were intentionally set to expire so they could appear cheaper; extending them comes with a cost that must be acknowledged.

Others have argued that the legislation does not need to be offset because the tax breaks included in the package will pay for themselves by improving jobs and economic growth. While there is value in providing information about economic impact of legislation as supplemental information, it can be problematic to rely on increased revenues from economic growth to offset the costs of legislation. Even the most pro-growth tax policies are unlikely to create enough economic growth to offset more than a fraction of the initial revenue loss, and there is little evidence about the growth effects of the full extenders package.

The current approach is bad for the fiscal situation and does nothing to improve the overall tax code. Instead, Congress should be working on a comprehensive plan to deal with the nation's fiscal challenges which would include entitlement reform and comprehensive tax reform.

--

Much more detail about the history, rationale, and cost of the extenders is available at our resources Tax Break-Down: Tax Extenders or Want to Understand the Tax Extenders? Here's a Few Charts.