Rethinking Tax Incentives for Education

Efforts to reform the tax code are picking up steam, with several tax plans introduced in the last month. In the House, Ways & Means Chairman Dave Camp (R-MI) created 11 tax reform working groups to deal with different parts of the tax code. Last month, one of these working groups released a bipartisan discussion draft which would reform tax incentives for education.

The Student and Family Tax Simplification Act, introduced by the chairs of the working group, Representatives Diane Black (R-TN) and Danny K. Davis (D-IL) consolidates four education incentives into a better-targeted credit. This bill will most likely save money, while increasing payouts to low-income individuals, increasing the progressivity of the tax code, and simplifying a confusing set of education incentives.

Representatives Black and Davis penned an editorial in Roll Call last week explaining why they took on the task of reforming tax benefits for education:

Today’s broken tax code does little to ease that financial burden or provide a sense of security that education will be a reality in the future. In fact, because it is such a complex and confusing system, more than 80 percent of Americans say that dealing with the tax code makes them frustrated and angry.

Representatives Black and Davis said they could imagine parents overwhelmed by the various tax incentives for education - 15 in all. The Representatives explain that "our desire to provide at least some relief from that frustration led the two of us to work even further to see how we could clean up the code and actually help students and families in their struggles to finance education costs."

The four education incentives changed by the bill are the American Opportunity Tax Credit (AOTC), its predecessor the Hope Credit, the Lifetime Learning Credit, and a deduction for tuition and fees.

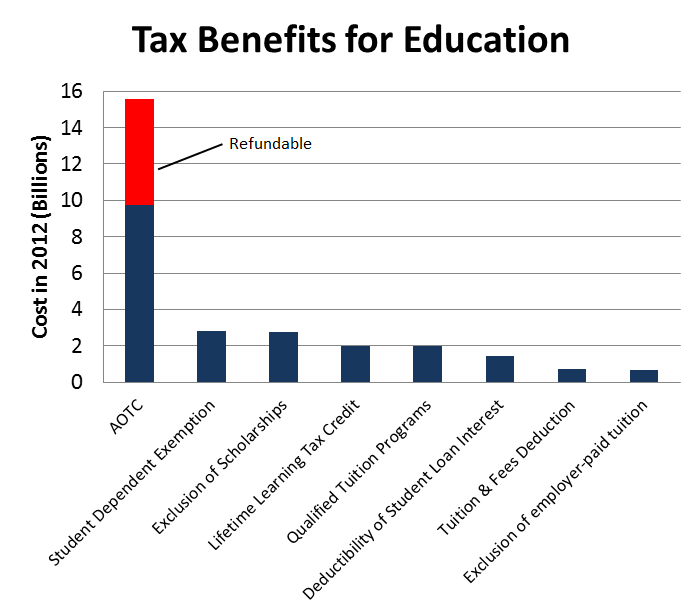

Source: Office of Management and Budget, 2013

The AOTC offers up to $10,000 to qualifying students or parents during the first 4 years of college (up to $2,500 per year). Up to 40% of the yearly credit ($1,000) is refundable for taxpayers who have no income tax liability. Instead of claiming the AOTC, a taxpayer can also choose to claim the Lifetime Learning Credit, a smaller credit available beyond the first 4 years of college, or a deduction for up to $4,000 for tuition and fees.

The Black-Davis education bill would combine these four provisions into a single, reformed American Opportunity Tax Credit.

How It Works

When the AOTC was enacted as part of the 2009 stimulus legislation, it increased the award amount of the existing Hope credit, made it available for 4 years of college (instead of two), made 40% of the credit refundable, and made it available to upper-middle income taxpayers. Previously, the Hope credit phased out for taxpayers earning over $57,000 ($107,000 for joint filers), while the expanded AOTC now phases out for taxpayers making between $80,000 and $90,000 ($160,000 and $180,000 for joint filers).

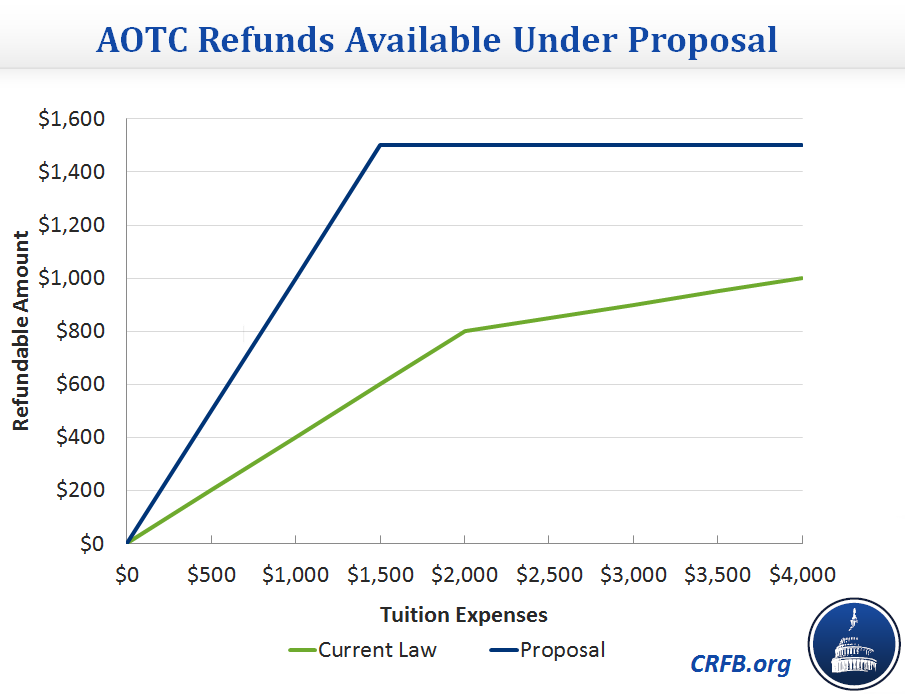

Black and Davis propose altering the AOTC by extending it permanently (under current law, it is set to expire at the end of 2017). Currently, the AOTC's benefit is spread relatively evenly across the income distribution. Black and Davis's proposal would increase the benefit to low-income individuals by increasing the maximum refund available to $1,500 (previously $1,000). They would additionally reduce the benefit to high-income taxpayers by lowering the phaseout levels. This bill would decrease the income phaseout levels to individuals making between $43,000 and $63,000 ($86,000 and $126,000 for joint filers), slightly less than Hope credit levels.

In addition to an increased refund, the formula for calculating refunds change so that a higher refund is available to people with fewer expenses. Under the current system, where a person must spend at least $4,000 on tuition to claim the full $1,000 refund. The proposal would make the first $1,500 of expenses eligible for a refundable credit.

Finally, this bill would index all components of the credit – including the total amount, refundable amount, and phaseout levels – to inflation after 2018 and change the way that Pell grants are counted against tuition.

Potential Costs of Proposals

Although this bill has not yet been scored by the Joint Committee on Taxation, it is still possible to get an idea how much revenue it will raise. While extending the AOTC permanently and increasing its refundable portion would cost money, these provisions are mostly paid for by eliminating the credit for upper-middle income individuals. Extending the AOTC permanently would cost around $60 billion over the next 10 years, and increasing its refundability about $20 billion. We estimate that reducing the phaseout threshold would raise enough to roughly offset these costs.

Changing the refund formula of the credit to increase refunds to low-income filers would cost roughly $5 billion, and indexing the provisions to inflation starting after 2018 would cost another $5 billion.

Most of the savings in this proposal come from repealing the Lifetime Learning Credit and allowing the tuition and fees deduction to expire, which would save between $20 and $30 billion over the next 10 years.

There are two ways to measure the bill. In official score estimates, CBO will measure the bill against current law, which assumes the AOTC will expire on schedule. However, the President's Budget and the CRFB Realistic Baseline assume the plausible scenario that the AOTC is extended permanently (a "current policy" baseline). From our rough estimates, it appears the working group set a goal of making an education credit that was more generous than current policy without costing any more than current law.

| Estimated Revenue Effects of the Student and Family Tax Simplification Act | ||

| Savings vs. Current Law (billions) |

Savings vs. Realistic Baseline (billions) |

|

| Extend the AOTC permanently | -$60 | $0 |

| Increase refundability to $1,500 | -$20 | -$20 |

| Change refund formula | -$5 | -$5 |

| Decrease phaseout range | $70 | $70 |

| Index to inflation after 2018 | -$5 | -$5 |

| Repeal the Lifetime Learning Credit | $30 | $30 |

| Repeal the Tuition and Fees Deduction | $1 | $1 |

| Total, Education Discussion Draft |

~$10 | ~$70 |

*Note: Estimates are very rough CRFB estimates based on available JCT scores and CLASP.

The bill does not change any other education incentives that currently exist – including the deductibility of student loan interest, the fact that scholarships are excluded from income, and several smaller exclusions. These provisions combined cost $130 billion per year.

The education proposal by Black and Davis simplifies the complex set of tuition tax incentives and makes it more progressive, eliminating a tax credit for graduate students and reducing the amount given to high-income taxpayers. It redirects the savings towards maintaining and enhancing the existing tax credits for college, particularly for low-income taxpayers. While it's far from final, this discussion draft released by the House Ways & Means bipartisan working group is an example of how tax reform can cut tax expenditures, raise revenue for deficit or rate reduction, and increase tax progressivity at the same time.