The Mid-Session Review: A Case for Building in Wiggle Room for Ever-Changing Projections

One of the reasons CRFB and other budget hawks have touted the benefits of putting debt on a downward path this decade -- in addition to the economic benefits, future budget flexibility, and the benefits of getting a running start on long-term debt -- is that it can help guard against overly optimistic projections. It is no secret that budget and economic projections can change, given that they always do. Putting the debt on a downward path, however, gives some wiggle room for the potential that projections deteriorate going forward. If estimates turn out to be overly pessimistic and the level of deficit reduction turns out to be unnecessary, policymakers are quite adept at finding ways to use that "extra" money, but they are not too adept at enacting additional deficit reduction when conditions warrant it.

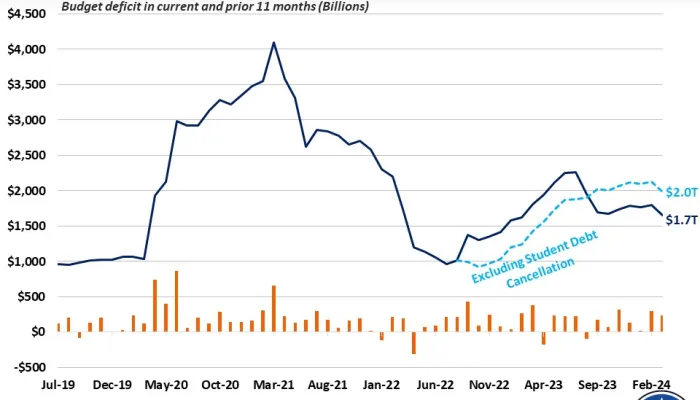

OMB's latest projections of the President's proposals, released in the Mid-Session Review early this week, is a perfect example of how our stance works. This outcome stood in great contrast to the big story in May of CBO's improving medium-term projections in their budget baseline. In addition, looking at an apples-to-apples comparison of current policy shows that using MSR's numbers has current policy on an upward path throughout most of the projection window (more on that below).

The MSR's projected debt is more than five percentage points higher in 2023 than CBO's estimate of the President's budget. A way to illustrate the difference in projections is to show how the same set of policy assumptions differs between CBO's numbers and OMB's numbers. In the graph below, we show the CRFB Realistic baseline assumptions using each agency's economic and technical assumptions. In both cases, debt is on an upward path in the later years of the ten-year window, but the levels differ by about the same as mentioned above.

One interesting thing that the new "OMB" Realistic baseline shows is that the decline in the level of debt as a percent of GDP that CBO anticipates following 2014 is almost non-existent using their numbers. The debt path does flatten out and decline by a tiny amount in the middle of the decade but then resumes on an upward path and a slope similar to CBO's path. Thus, even the short-term decline in debt that most people take for granted in CBO's projections is not a certainty if their economic projections don't play out.

Source: CBO, OMB, CRFB calculations

This divergence does not mean necessarily that one projections is inherently better than the other. But it does mean that no projection is set in stone, so lawmakers should be cautious and prudent in dealing with them. The difference between CBO's and OMB's projections show that there is no one way to see the budget going forward, so we must be prudent in preparing, and thus budgeting, for the future.