Interest Spending Looms Large in the Next Decade

In a recent blog post on The Wall Street Journal's Washington Wire, director of Brookings Institution's Hutchins Center David Wessel outlines a major reason why the high and growing level of federal debt is a concern: growing interest spending. Wessel makes a few points that we have also made previously: high debt leaves the federal government susceptible to rising interest rates, and higher interest spending will crowd out other spending. It's worth expanding on his discussion of the reasons for and consequences of higher interest spending.

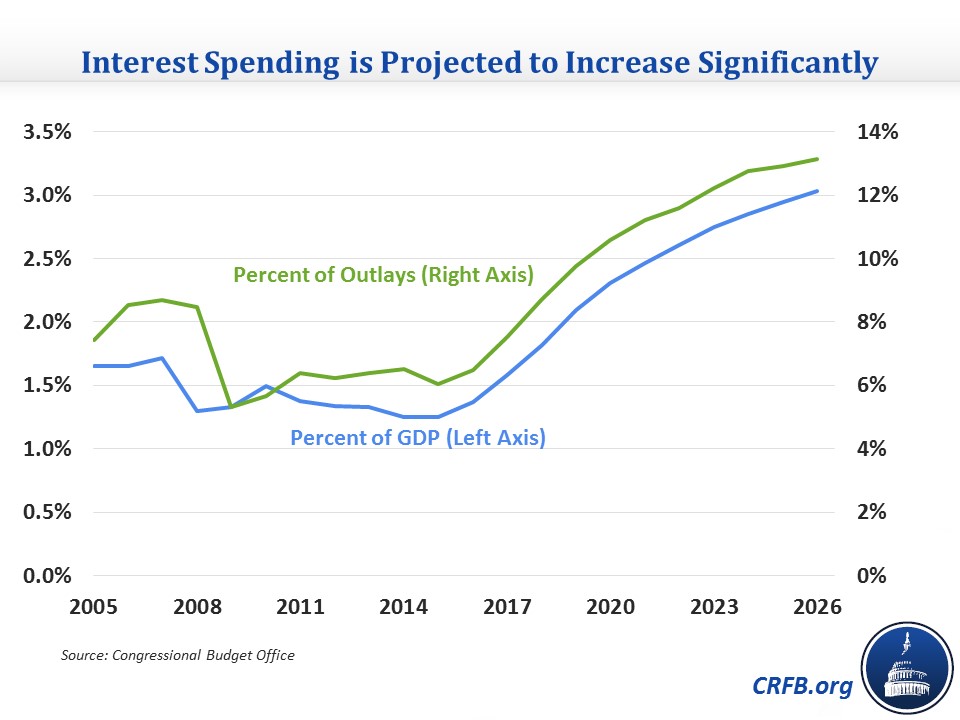

Wessel notes that interest spending in CBO's latest budget projections will rise rapidly as a share of spending over the next decade, from just over 6 percent in 2016 to 13 percent by 2026. This is primarily due to interest rates rising from their current low levels and returning closer to pre-recession rates but also because debt is expected to climb. By the end of the ten-year period, interest as a share of federal spending will be the highest since the 1985-1999 period when interest rates were much higher but debt was lower. Interest will also rise from 1.4 percent to 3 percent of GDP by 2026, the highest total since 1995 and the sixth-highest total in modern history. Wessel points out that within a decade, interest will exceed the size of all non-defense appropriated spending.

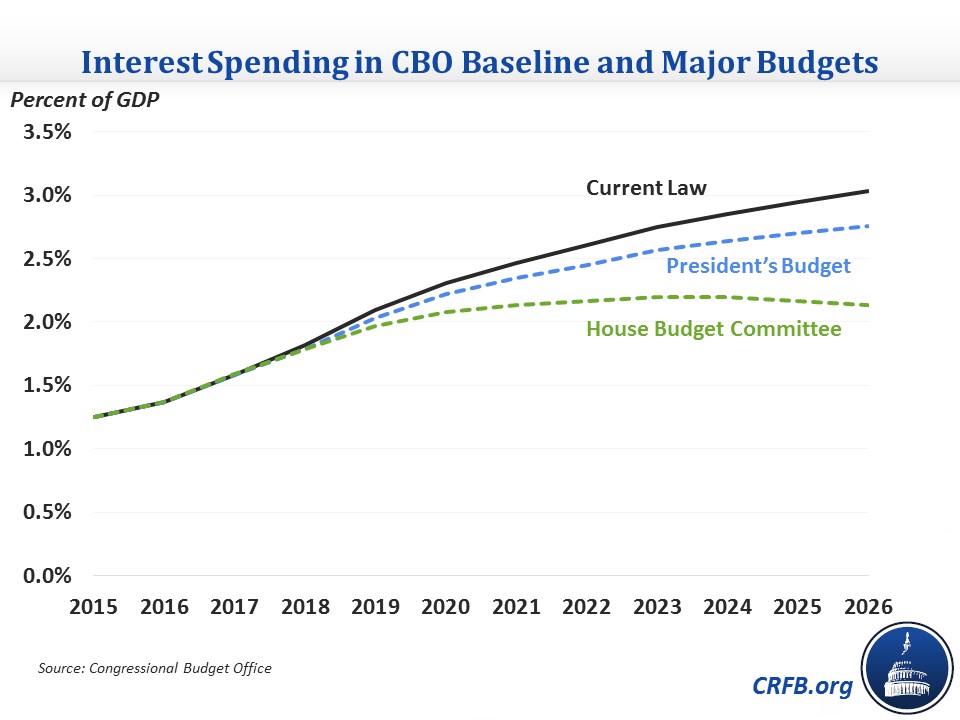

Wessel also notes that the President's budget, which includes $2.4 trillion of ten-year deficit reduction and $300 billion of interest savings, still does not do much to stop the trend of growing interest costs, with interest spending reaching 12 percent of spending in 2026. Interest would also double as a percent of GDP to 2.8 percent by 2026. Even under the House Budget Committee's budget resolution, which prescribes $7.9 trillion of deficit reduction and a balanced budget in ten years, interest would take up 11 percent of outlays and 2.1 percent of GDP in 2026. These numbers show that even plans that dramatically reduce deficits take a while to bring debt down to a level that is less susceptible to interest rate changes.

This last point drives home why we argue against delaying action on the federal debt: interest rates and spending can change quickly, but bringing down debt takes time. The longer policymakers wait to reduce our current high level of debt, the longer we remain exposed to changes in interest rates.