How Senator Ted Cruz Would Increase Defense Spending

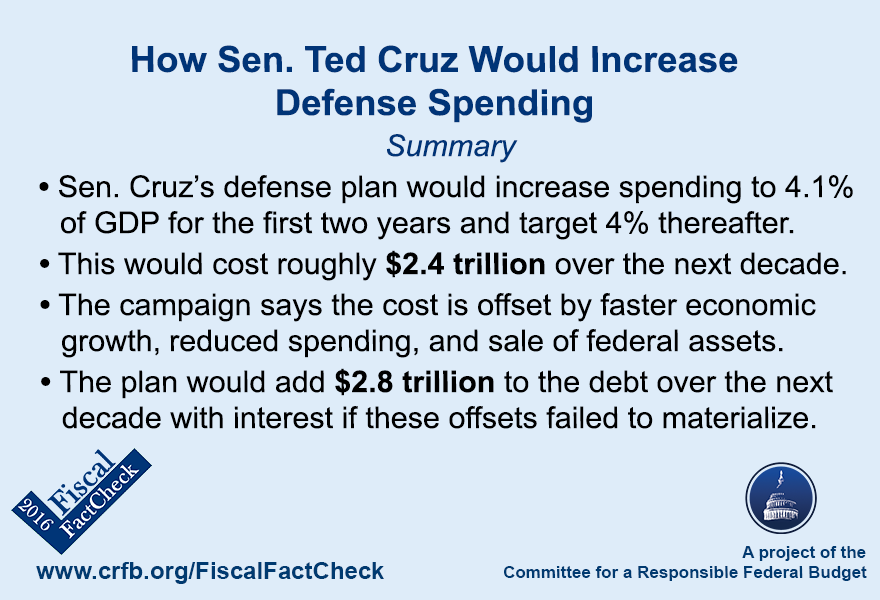

The campaign has said it would pay for these costs through faster economic growth, reduced spending, and the sale of federal assets. However, the cuts proposed to date would only cover a small fraction of the costs, and the needed rate of economic growth to pay for his plan is likely not achievable. If these offsets failed to materialize entirely, the plan would add $2.8 trillion to the debt over the next decade with interest.

Below, we explain Sen. Cruz’s defense plan as outlined on his website.

The Details of Sen. Cruz’s Plan to Rebuild America’s Military

Sen. Cruz proposes to reverse the defense cuts made in recent years and to further increase defense spending by strengthening both conventional forces and what he describes as “strategic forces.” Among Sen. Cruz’s proposed increases include:

- At least 100,000 more military combatants, including at least 50,000 more active duty army soldiers (for a total of 1.4 million and 525,000, respectively)

- 2,000 additional Air Force aircraft and 2 additional aircraft carriers (for a total of 6,000 and 12, respectively)

- At least 75 more naval ships (for a total of 350)

- 12 new Ohio Class ballistic missile submarines (for a total of 26)

- A new anti-missile defense base on the East Coast

Sen. Cruz’s plan also calls for modernizing air and ground nuclear strike capabilities, supporting allies to develop anti-missile defense capabilities, strengthening our own anti-missile defense capabilities, and shoring up U.S. cybersecurity including by instituting a new “policy of retribution” in response to cyberattacks. At the same time, Sen. Cruz would audit the Pentagon in order “to identify and eliminate unnecessary programs.”

A more detailed description of Sen. Cruz’s defense plan is available here.

The Cost of Sen. Cruz’s Defense Plan

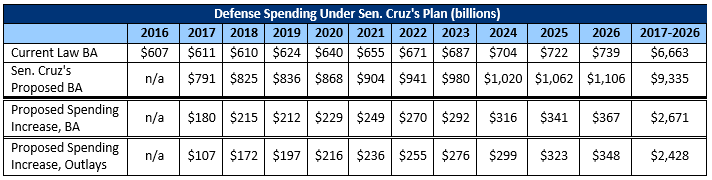

Sen. Cruz argues “we must be prepared to invest at least 4.1% of GDP [on defense] over the first two years of my administration” and proposes to use 4 percent of GDP per year as a guideline after that. By comparison, under the Congressional Budget Office’s current law baseline the country is projected to spend an average of 2.8 percent of GDP over the next decade – with costs falling from 3.2 percent to 2.6 percent of GDP by 2026.

To calculate the cost of Sen. Cruz’s plan, we assume his fiscal targets represent how much he would like to spend in budget authority (BA) – the amount that is newly obligated each year – over the next decade. For Fiscal Year 2017, 4.1 percent of GDP totals about $790 billion, $180 billion higher than current law budget authority. By 2026, budget authority of 4 percent of GDP would total $1.1 trillion, $370 billion higher than under current law.

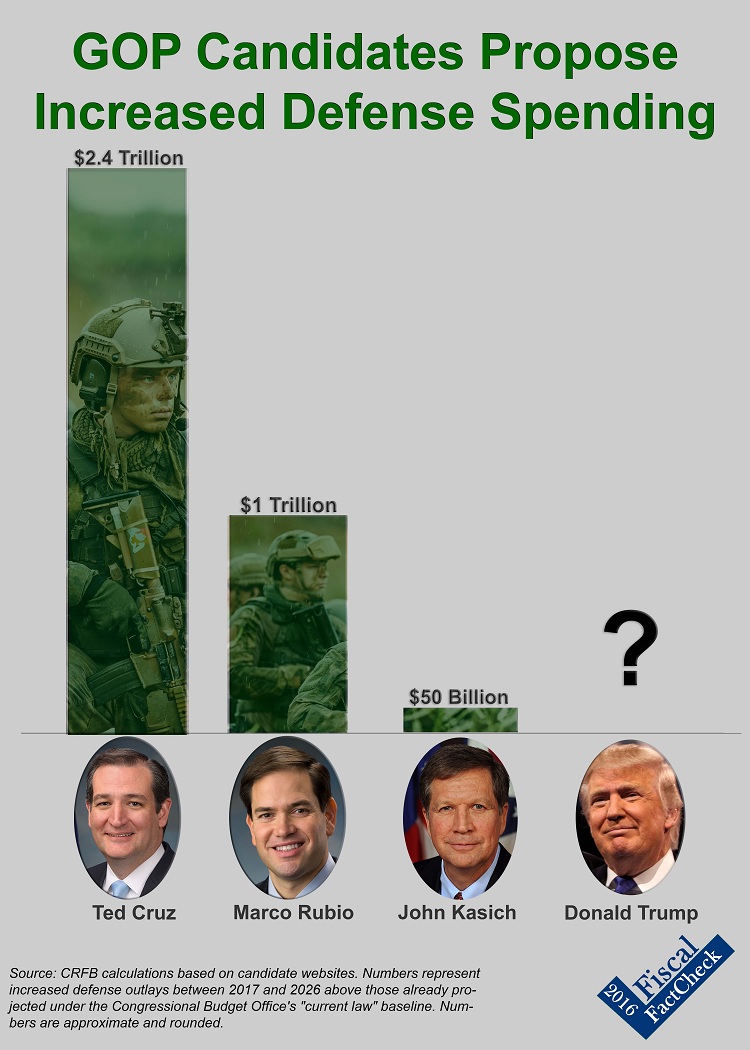

Over ten years, this means Sen. Cruz’s plan would call for $2.7 trillion more in budget authority than current law. When converted to outlays – the amount actually spent as opposed to just appropriated – Sen. Cruz would increase defense spending by $2.4 trillion over the next decade. Note that these increases would be significantly larger than those proposed by other Republican candidates, and they could be even larger if Sen. Cruz meant the 4.1 or 4 percent of GDP spending targets in other ways (see Appendix for further cost estimates under different scenarios).

Assuming these costs are not offset, this means his defense plan would add $2.8 trillion to the debt by 2026 with interest, the equivalent of increasing debt by roughly 10 percent of GDP.

Importantly, though, Sen. Cruz has called for paying for this cost – through faster economic growth, reduced spending, and sale of government assets. The $500 billion of domestic spending cuts Sen. Cruz has proposed so far would cover about one-fifth of the costs. Unfortunately, the level of economic growth needed to pay for Sen. Cruz’s defense plan would be incredibly difficult to achieve, and what growth does materialize would likely fail to even pay for Sen. Cruz’s tax plan. Sale of federal assets could generate some funds, but as we’ll explain in a future post, those gains are not likely to be large relative to Sen. Cruz’s proposed cuts; they would also represent only one-time savings to pay for a sustained spending increase.

* * *

Sen. Cruz deserves some credit for putting forward specific details reflecting his vision on defense spending as well as expressing a commitment to pay for this increase. However, his defense plan would be quite expensive both in absolute terms and relative to the other candidates. Moreover, the non-defense spending cuts he has outlined to date would only pay for a fraction of his plan, and neither economic growth nor asset sales – his two other currently proposed pay-fors – are likely to be able to make up the difference. We look forward to more proposals and details as the campaign continues.

Appendix

The table below breaks down the year-by-year numbers of defense spending under Sen. Cruz’s plan compared with the current law defense spending baseline.

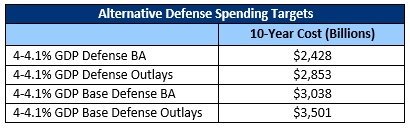

The analysis above shows if total defense budget authority was set at 4.1 and 4 percent of GDP, but the table below shows alternative estimates if Sen. Cruz intended his 4.1 percent and 4 percent of GDP targets to be in terms of total defense outlays, base (non-war) defense budget authority, or base defense outlays.