How to Get This Year's Budget Process Back on Track

On October 1, lawmakers will have to pass new appropriations or a continuing resolution, or the government will shut down for the second time in two years. This is one part of the four-part "gathering storm" that lawmakers face over the remainder of the year. One of the sticking points in funding the government is the return of the sequester-level spending caps, which will essentially hold FY 2016 spending to the previous year's level. Both parties have proposed higher spending levels, but have done so in different ways. To show a way around the impasse, CRFB has released the Sequester Offset Solutions (SOS) plan, which provides $300 billion of sequester relief that is fully offset.

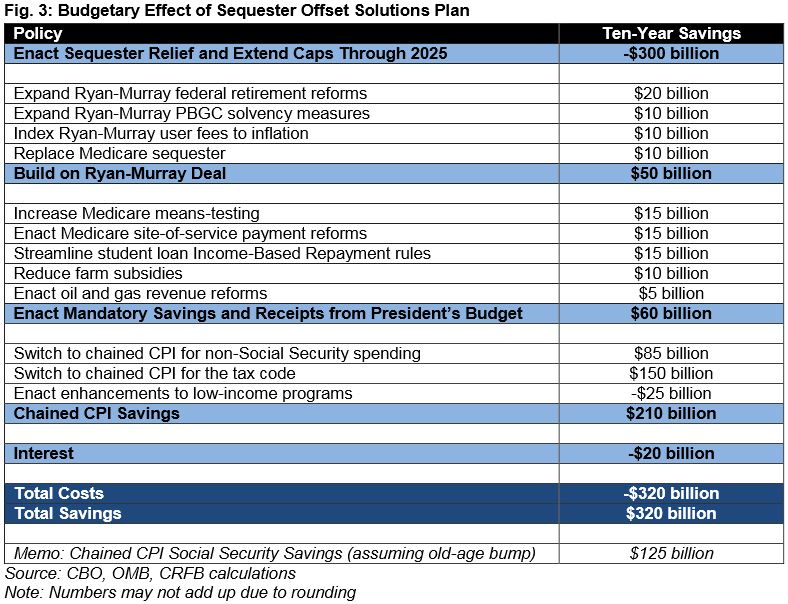

The SOS plan consists of four parts:

- Sequester Relief: The plan repeals about half of the sequester over the next two years, then allows the spending caps to grow with inflation after 2017. This provides $300 billion of sequester relief in total with smaller amounts of relief over time.

- Offsets for Two-Year Relief: To offset the $90 billion cost of the two-year sequester relief, the plan outlines $110 billion of savings split roughly equally between policies that build off the 2013 Ryan-Murray deal and targeted mandatory program savings and receipts from the President's budget. The savings are slightly higher than the cost to account for the interest costs associated with the upfront relief.

- Offsets for Longer-Term Relief: The plan would offset the caps beyond 2017 with a policy that was a part of nearly every major budget negotiation in recent years – the adoption of the chained CPI. Chained CPI is widely regarded as a more accurate measure of inflation than the current CPI, and adopting it across the government would generate savings on the revenue and spending side. Most of those savings would go toward sequester relief. However, the plan would not use the Social Security savings to fund discretionary spending, instead using those savings to strengthening Social Security solvency.

- Strengthened Enforcement of Budget Caps: In exchange for higher spending caps, the SOS plan would put in place reforms to ensure that policymakers could not circumvent those caps as easily with gimmicks. Specifically, it would shut down strategies that get around the caps either by shifting defense spending to the uncapped Overseas Contingency Operations category or by using fake mandatory spending cuts to offset real discretionary spending increases.

The plan would be deficit-neutral over ten years. Because the savings are permanent (instead of the temporary sequester) and grow faster than the costs, the plan would reduce deficits and debt in the second decade by $1.3 trillion or $1.8 trillion if the Social Security savings are included. These savings translate into 5 percent of GDP lower debt in 2035. These numbers do not include the economic benefits of replacing the upfront cuts or reducing long-term deficits, which we estimate would raise GDP by 0.2 percent in 2016 and by 0.3 percent in 2035.

Of course, this plan is just one of many possible ways to do fiscally responsible sequester relief. Many policymakers, including President Obama, would prefer even higher amounts of discretionary spending, and our appendices provide different sequester relief options and possible offsets.

The SOS plan is a reasonable way to provide sequester relief without adding to deficits (and indeed reducing them in the longer term). Lawmakers should stick to this type of arrangement if they increase spending caps this fall.

Read the full Sequester Offset Solutions (SOS) plan here.