Growing Health & Interest Spending to Overwhelm Flat Revenue

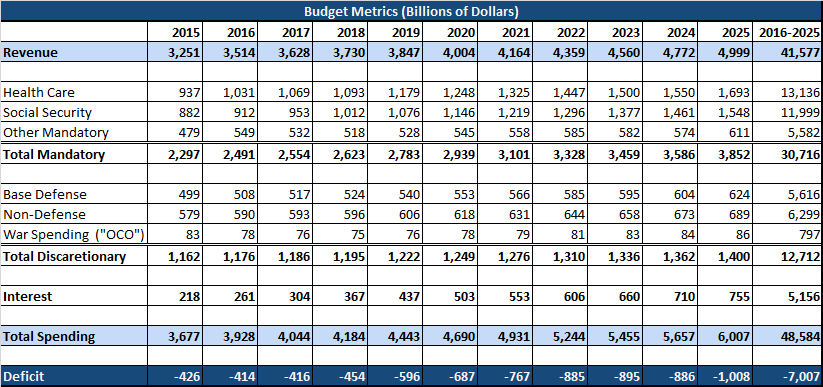

CBO's recent budget projections show debt growing in the latter half of the decade as deficits widen. Entitlement spending will continue to grow as a result of an aging population and increased health care costs, and revenues are projected to remain relatively flat, leaving the budget with ever-growing deficits and increasing interest payments. By 2025, annual deficits will reach $1 trillion for the first time since 2012.

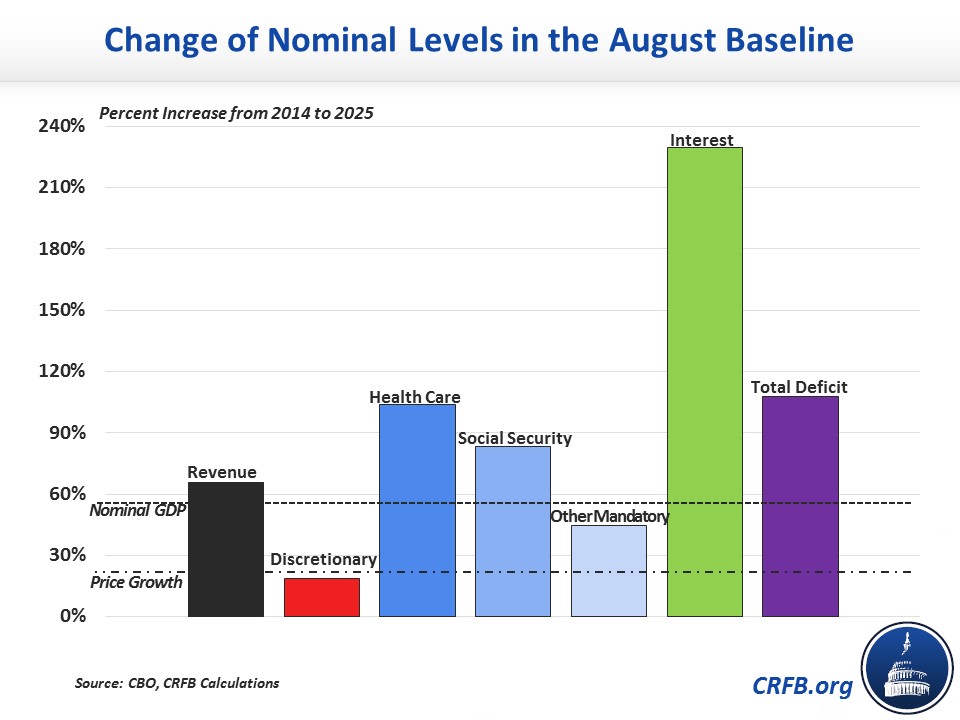

Deficits will remain roughly stable over the next few years as revenue collections temporarily spike – due to the recovering economy, unexpectedly high revenue this year, and CBO's assumption that the tax extenders will remain expired. However, deficits are projected to begin growing again if nothing is done by 2018, and interest on the debt will be the fastest growing portion of the budget, more than tripling between 2015 and 2025.

All the major categories of spending, revenue, and the deficit are growing nominally. From 2014 to 2025 interest spending will rise 230 percent, and discretionary spending, which is limited by the sequester-level caps, will still grow by just under 20 percent -- though that is slower than price growth over the same period. Both health care spending and the total deficit are projected to more than double by 2025.

All these projections are based on CBO's "current law" baseline, which uses conventions that may not happen in reality. For instance, CBO is required to assume that war spending will increase indefinitely with inflation, rather than being decreased as currently planned. The baseline also assumes that insolvent trust funds, such as the Highway Trust Fund and Social Security Disability Insurance, would have their obligations covered by general revenue, which would require a change in law. The baseline also doesn't account for future acts of Congress: policymakers may enact additional unpaid-for legislation beyond the $180 billion they have added to the debt this year, including the $2.5 trillion they could potentially add if they handle this fall's deadlines irresponsibly. For more on this fall's Gathering Storm see our recent paper. Based on these possible outcomes, we have calculated two additional alternative budget paths.

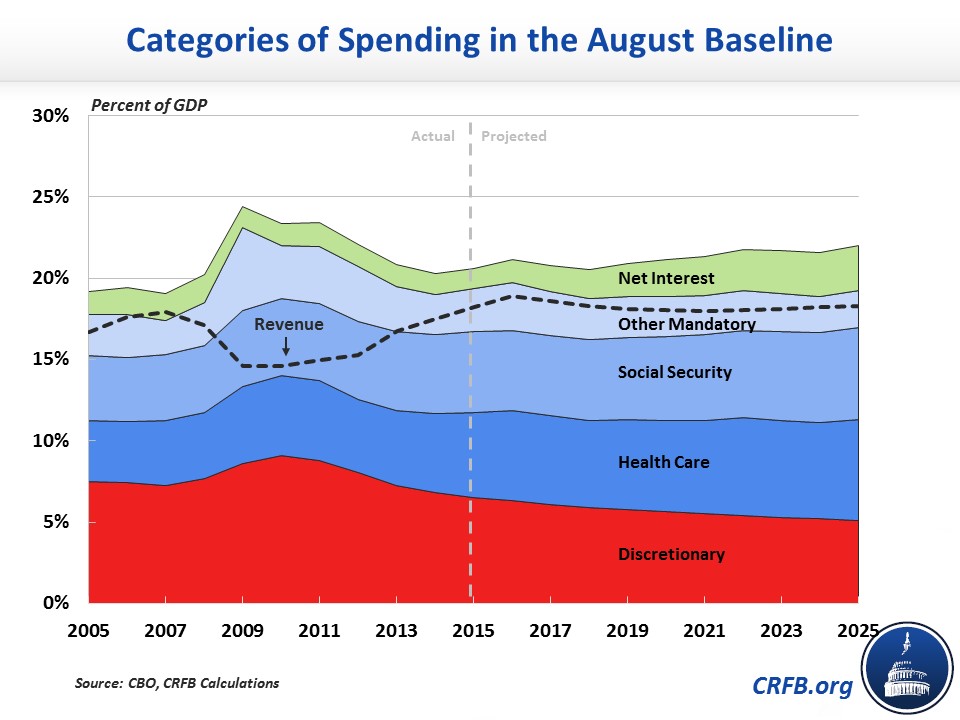

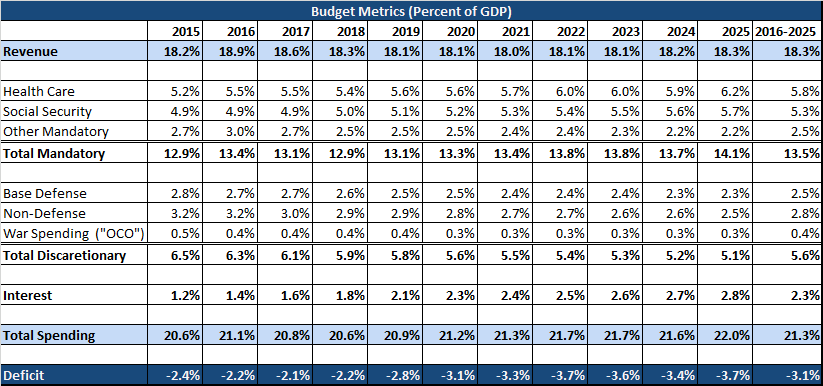

When viewed as a percentage of the economy, mandatory spending and interest are the parts of the budget contributing to. Health care programs grow from 5.2 percent of GDP this year to 6.2 percent of GDP by 2025. Social Security will grow from 4.9 percent of GDP to 5.7 percent over the same time period. These two areas' portion of the budget will grow from 50 percent of total spending this year to 54 percent. Interest spending will more than double as a share of GDP and take up nearly 13 percent of the budget in 2025, up from 6 percent in 2015.

Meanwhile, the defense budget, non-defense discretionary spending, and other mandatory spending -- which includes safety net programs, federal retirement spending, and several other programs -- all shrink as a percentage of the economy, and their share of spending drops from 45 percent to 33 percent over the next ten years.

Although our short-term deficits are manageable, our long-term debt problems are far from solved. Policymakers should address the drivers of the debt through some combination of entitlement reform to slow the growth of mandatory spending and tax reform that raises enough revenue to meet our spending commitments.

This blog is a follow-up analysis of CBO's August 2015 baseline. See our full analysis of that report.