Governor Bobby Jindal Releases Tax Reform Plan

Republican presidential candidate Louisiana Governor Bobby Jindal announced his tax reform plan with a centerpiece that promises to ensure every American pays at least a little tax. The plan cuts taxes for individuals and eliminates the corporate tax and estate tax. Finally, it taxes capital gains and dividends as ordinary income under three consolidated brackets. According to one estimate, the plan would cost $9 to $11.4 trillion, which represents about one-quarter of all government revenue.

Individual Income Tax Reform

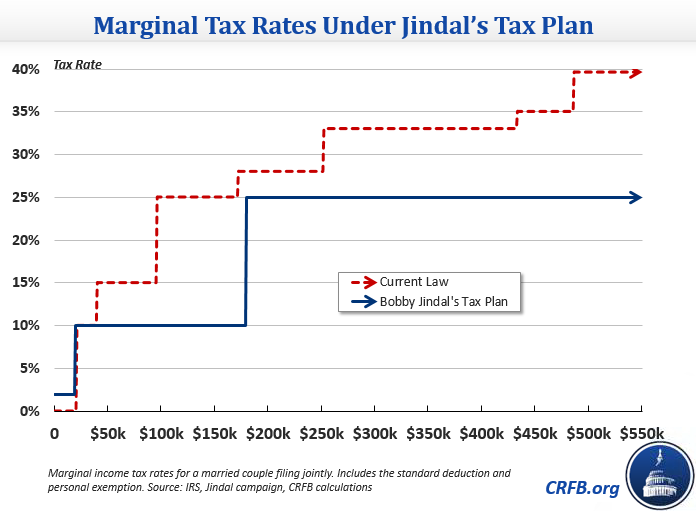

Governor Jindal’s plan would consolidates the tax brackets from seven to three – 2 percent, 10 percent and 25 percent, with most citizens falling into the middle bracket of 10 percent instead of the 15 and 25 percent brackets they're taxed at today. This plan is similar to, but reduces rates more aggressively than, either Jeb Bush’s or Donald Trump’s plans.

In addition to lower rates, the plan identifies several other tax cuts including:

- Repealing the Alternative Minimum Tax (AMT)

- Consolidating existing savings incentives into a tax-free savings account with a cap of $30,000 per year. Currently uncapped accounts like 529 plans, would not be subject to the new restrictions.

- Eliminating the marriage penalty (and increasing marriage bonuses).

- Eliminating all Affordable Care Act taxes.

Jindal’s plan would be partially paid for by:

- Eliminating the personal exemption and standard deduction, but adding a new, nonrefundable dependent credit

- Eliminating all itemized deductions except for the charitable and mortgage interest deductions, while reducing the cap for the mortgage deduction by 50 percent.

- Taxing all capital gains at ordinary rates (the top rate would increase from 23.8 to 25 percent)

Interestingly, this plan is one of the few campaign plans so far to address the largest tax break – the unlimited exclusion for employer-provided health insurance, which would be replaced with a new standard health deduction available to anyone with health insurance.

While the plan attempts to create a structure where everybody would pay something in taxes, it is not clear that this is achieved. According to the Tax Policy Center's report on those who pay no income tax, the standard deduction and personal exemption only account for about half of the people who pay no income tax. In order to make the other half start paying tax, Jindal's plan would need to eliminate credits for children, tax Social Security benefits, and limit education credits, municipal bonds, and the exclusion for combat pay, among other benefits. This plan does not address how it would deal with these provisions.

Corporate Tax Reform

On the business side, the plan would eliminate all corporate taxes. Corporate earnings would only be taxed as capital gains after they are distributed to shareholders. The plan would impose a one-time 8 percent tax on past overseas earnings of American companies. Future earnings would be taxed at 0 percent, both because there would be no corporate tax and because the plan endorses a territorial system which wouldn't subject foreign earnings to taxes.

Other Tax Changes

This plan addresses a few taxes other than income tax. It preserves the Earned Income Tax Credit by rolling it onto the payroll system and away from the income tax. Additionally, the plan repeals the gift tax and the estate tax.

Revenue Impact

The right-leaning Tax Foundation released an analysis of Jindal’s plan and found that on a static basis it would cut $11.4 trillion over ten years – cutting taxes for corporations as well as high and middle-income earners, while increasing taxes on the poorest.

When included an estimated boost in Gross Domestic Product (GDP) of more than 14 percent, the Tax Foundation found that the plan would cost $2.4 trillion less, reducing revenues by only $9 trillion over ten years. However, that growth estimate is likely larger than official sources would predict, partially because it does not account for the negative economic effects of growing debt.

| Economic and Revenue Analysis of Jindal’s Tax Reform Plan: “Everybody Has to Have Some Skin in the Game” |

||

| Revenue Impact | Ten-Year Cost | |

| Conventional Score (no economic growth) | $11.4 trillion | |

| Dynamic Score | $9 trillion | |

| Economic Growth from Tax Reform Alone | ||

| Increase in GDP by the 10th Year | 14.4% | |

| Average Increase in GDP over the next 10 years | 5.75% | |

Source: Tax Foundation, CRFB calculations for average growth

That estimate may be slightly too costly because Tax Foundation did not score the savings from replacing the exclusion for employer sponsored health insurance with a deduction. Although the plan does not offer much detail for this proposal, President Bush presented a similar idea in 2007, which the Joint Committee on Taxation scored as saving $334 billion.

Conclusion

It is promising that candidates are talking about reforms to our complicated tax system. However, as a standalone plan, these tax policies would greatly contribute to the nation’s growing debt. Indeed, assuming the midpoint of a $10 trillion cost (before interest) and no other changes, debt would grow from 74 percent of GDP today to somewhere around 120 percent by 2025 – well above current projections of 77 percent.

Given the severity of the country’s long-term fiscal situation, we will likely need a combination of spending cuts, entitlement reform, and revenue increases – not tax cuts, to bring us back to a onto a sustainable fiscal path. At a minimum, we hope that any plan is fully paid for. In that vein, we hope that Governor Jindal’s proposals for spending cuts and entitlement reform would be enough to at least pay for these tax cuts.