GAO: Fiscal Sustainability Is a Growing Concern for Some Key Federal Trust Funds

Last week, the Government Accountability Office (GAO) released a report on the financial health of the nation’s federal trust funds. Requested by Senate Budget Committee Chairman Mike Enzi (R-WY) and Senator Mike Braun (R-IN), the report shows that insolvency dates for major trust funds are fast approaching and gives lawmakers a renewed sense of urgency to explore potential solutions like the bipartisan TRUST Act.

According to the report, under current law, the Highway Trust Fund will be insolvent by 2022, the Pension Benefit Guaranty Corporation Multiemployer Trust Fund by 2025, the Medicare Hospital Insurance Trust Fund (Medicare Part A) by 2026, the Social Security Old-Age and Survivors Insurance Trust Fund (OASI) by 2034, and the Social Security Disability Insurance Trust Fund (SSDI) by 2052.

Find out how old you will be when the Social Security trust funds run out and use our reformer tool to plot a path to solvency.

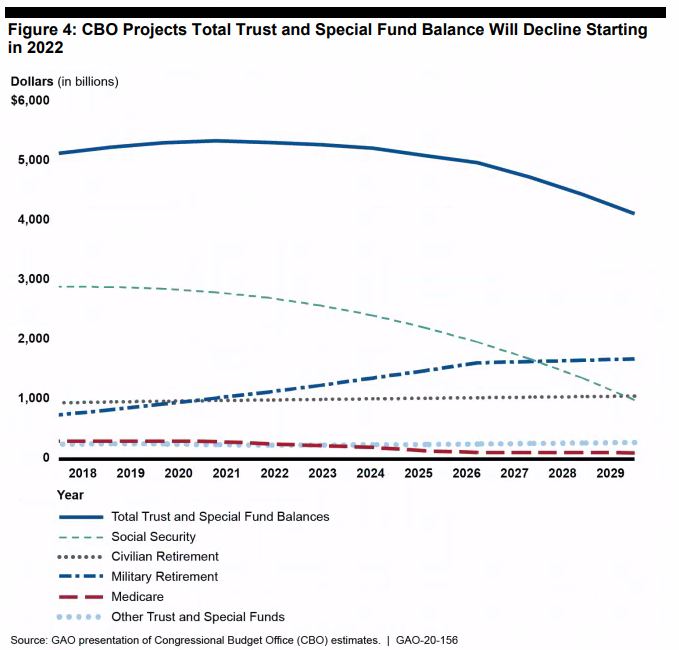

GAO’s report is yet another reminder of the precarious financial state of some of the nation's most important federal programs. Per the report, while trust fund balances grew over the past five fiscal years, they are expected to start shrinking beginning in 2022, largely as a result of declines in the Social Security and Medicare trust fund balances. Over time, persistent trust fund deficits will lead to increased federal borrowing as trust funds will be forced to redeem their holdings of U.S. Treasury securities in order to continue to meet their obligations.1

Most importantly, the report highlights the pressing need for action from Congress.

A bipartisan group of lawmakers in both the House and the Senate are pushing for the establishment of "rescue committees" to address the impending insolvency of the country’s most important trust funds. The Time to Rescue United States Trusts Act (TRUST Act) – introduced in November of last year in both the House and the Senate – would create separate, bipartisan commissions tasked with preventing the insolvency of and otherwise improving each major, endangered federal trust fund program that spends more than $20 billion per year and is in danger of becoming insolvent by 2035. This criteria would cover both Social Security trust funds, Medicare Part A, and the Highway Trust Fund. The commissions would provide recommendations on how to prevent insolvency as well as offer ways to simplify and improve the programs. Any recommendations would receive an expedited vote in Congress. The bill is gaining momentum on and off Capitol Hill and currently has 14 sponsors or cosponsors in the House and 11 in the Senate.

GAO’s report is yet another warning to members of Congress that bipartisan leadership and action is urgently required to safeguard retirement, senior health care, and infrastructure investment for the future. By establishing bipartisan rescue committees, the TRUST Act will provide an important forum in which leaders can not only explore ways to avert insolvency, but also pro-growth reforms that will improve and strengthen the programs for current and future generations.

1 When U.S. Treasury securities are held by the trust funds they are considered intragovernmental debt and are not counted as debt held by the public.