Examining the Domestic Production Activities Deduction

It is well known that the corporate tax code is littered with tax provisions that cost the government revenue. Today, the U.S. has the highest top marginal rate in the world, discouraging growth and investment, and a complex corporate code that diverts resources from more productive purposes and creates disincentives. While some tax provisions may be serving a legitimate purpose, there are others that provide spillovers beyond lawmakers' original intent. Currently, the House Ways and Means Committee is making significant progress on tax reform, releasing three discussion drafts on international taxes, financial products, and small businesses.

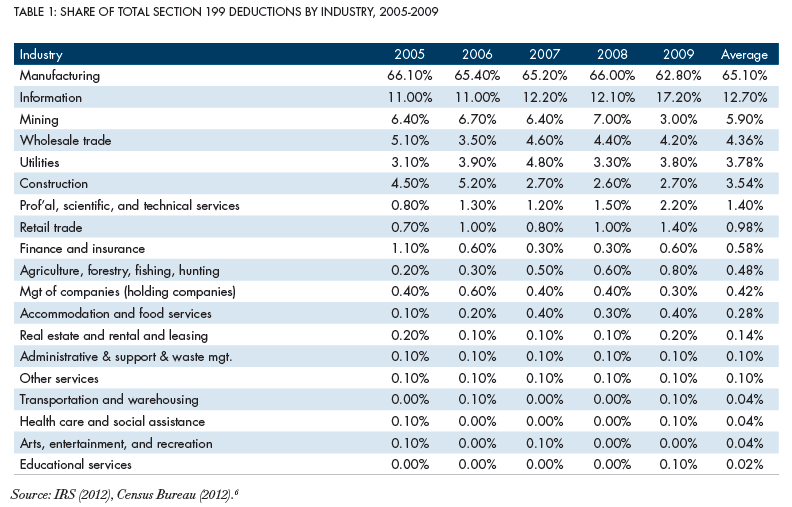

A new report from Robert Shapiro of the Progressive Policy Institute, "Anatomy of a Special Tax Break and The Case for Broad Corporate Tax Reform", examines one such tax expenditure in Section 199 of the tax code. Since 2006, corporations have been able to take a deduction for qualifying "domestic production activities." The intent was to promote domestic manufacturing, replacing an earlier export subsidy that was frowned upon by the World Trade Organization, but the report estimates that the provision now covers one-third of corporate economic activities. Shapiro provides a table that shows that over one-third of the deduction was claimed by industries other than manufacturing, including businesses in the information, mining, wholesale, and finance and insurance sectors. Shapiro in particular uses the example of Starbucks; while the retail food business doesn't qualify for the deduction, a special exception exists for business that roasts beans to make coffee, allowing Starbucks to lower its effective rate by 2 percentage points in 2009.

Source: Shapiro

In the report, Shapiro finds little evidence that Section 199 has had a substantial contribution to job growth. Rather, he argues that the provision may distort business decisions and investments by incentivizing businesses to shift resources to qualify for the deduction. This may be especially true with pass-through businesses that face a higher tax rate under the individual code. Shapiro explains:

However, tax provisions such as Section 199 artificially raise the post-tax returns of certain industries and companies and, within those industries and companies, the post-tax returns of certain activities. The result is that investment, entrepreneurism and other economic resources are no longer allocated based simply on their economic returns. By raising the post-tax returns of certain industries, firms and activities which happen to qualify for Section 199 deductions, the provision channels economic resources, on the margin, to those qualified industries, firms and activities. In so doing, it inescapably reduces the efficiency and productivity of the economy.

Not only may the deduction be creating distortions, a significant amount of revenue is forgone as a result of the provision. The Joint Committee on Taxation estimated the Section 199 provision that $14.1 billion in 2013 and $78.2 billion from 2013-2017. Revenue from tax expenditures like the domestic production activities deduction could be used to lower corporate marginal rates, deficit reduction or a combination of both.

We've explored corporate tax reform in a paper and also have created a corporate tax calculator, in which users can eliminate corporate and individual tax expenditures with the goal of lowering the top corporate tax rate or reducing the deficit or a combination of both. Eliminating the domestic production deduction for all businesses is estimated to raise roughly $16 billion per year, or finance a 1.5 percentage point reduction in the corporate rate, while eliminating it just for C-corps would finance a 1.2 percentage point reduction (actual rate reduction would dependent on base and starting point). It's not surprising that this provision was eliminated in the Fiscal Commission, Domenici-Rivlin, Rangel, and Wyden-Gregg tax reform plans.

Both the individual and corporate tax codes are overly complex and inefficient, but this can be corrected in comprehensive tax reform. We can reduce arbitrage in the tax code and promote growth, but lawmakers must be willing to take a close look at many provisions in the tax code to either eliminate or improve them. With both House Ways and Means Chairman Dave Camp (R-MI) and Senate Finance Chairman Max Baucus (D-MT) committed to taking up comprehensive tax reform, this deduction could be one many tax provisions to be reformed or eliminated.

Click here to try out our corporate tax simulator.

Note: This blog has been updated as of 5:15 PM on March 25.