CBO's Economic Analysis of the President's Budget

Although CBO's analysis of the budgetary effects of the President's budget was released last month, today they released a very useful report on the economic effects of the budget. The results are mixed, depending on the time period you look at.

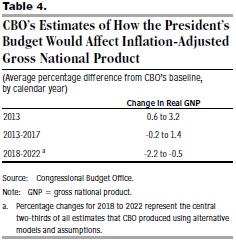

CBO uses two different sets of effects to evaluate the President's proposals. For 2013-2017, they consider short-run economic effects, namely those involving aggregate demand. For 2018-2022, they consider long-run effects, those related to capital stock, labor supply, and productivity.

On the first part, President Obama does pretty well, averting many parts of the fiscal cliff, and including some new stimulus as well. In 2013 alone, CBO estimates the budget would raise real GNP by somewhere between 0.6 and 3.2 percent; in other words, using real GDP numbers, it would increase the size of the economy by between about $80 billion and $435 billion. Also, the mean of that range, 1.9 percent, is just about what we estimated averting the entire cliff would do to the economy (although that was through 2014). For 2013-2017, CBO estimates the effect would be smaller as the economy got closer to potential, ranging from a 1.4 percent increase to a 0.2 percent decrease.

The 2018-2022 period does not look as good for the President. On the negative side, the budget would have higher deficits than current law, and higher effective marginal tax rates on capital income than current law due to the impact on some tax provisions (carried interest, the itemized deduction limitation, among others). Both of these have the effect of reducing the capital stock, which hurts growth in that period. On the positive side, the budget reduces marginal tax rates on labor through its extension of most of the 2001/2003 tax cuts and the AMT patch. Overall, the negatives outweigh the positives: CBO estimates a reduction of real GNP ranging from 0.5 to 2.2 percent over this period.

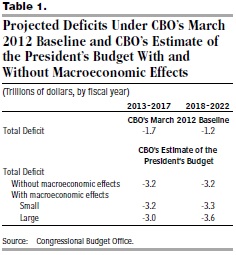

CBO also estimates how deficits would differ if the macroeconomic effects of the budget were incorporated. For 2013-2017, the economic changes would result in somewhere between little change and a $200 billion reduction in deficits. For 2018-2022, deficits would be between $100 billion and $300 billion higher. Using the middle of those ranges puts deficits about $150 billion higher from 2013-2022.

In short, CBO's report shows the value of averting the fiscal cliff and bringing down deficits for the economy. The President's budget does pretty well on the first part but does not do enough on the second. A comprehensive fiscal plan that makes economically smart changes would do good on both fronts.