CBO Report Shows Return of Trillion-Dollar Deficits

Trillion-dollar deficits are coming back in 2025. That's one of the many stories told by the new budget update released today by the Congressional Budget Office. The deficit, which had fallen to a post-recession low of $483 billion (2.8 percent of GDP) last year, is projected to fall slightly more this year to $468 billion (2.6 percent of GDP), but increase to reach $1.09 trillion (4.0 percent of GDP) by 2025.

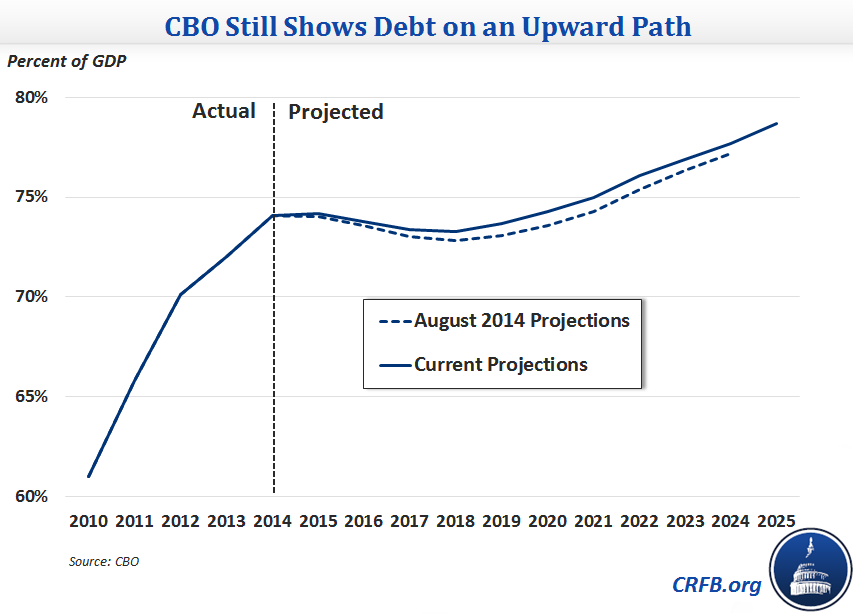

Debt will also grow substantially in nominal dollars, from $13 trillion today to $21.6 trillion by 2025. As a percent of GDP, debt will remain stable near its current post-war record of around 74 percent of GDP through 2020, but then it too will start rising quickly, reaching nearly 79 percent of GDP by 2025 and continuing to grow thereafter. As CBO explains, this continuing long-term growth would not be sustainable:

Such large and growing federal debt would have serious negative consequences, including increasing federal spending for interest payments; restraining economic growth in the long term; giving policymakers less flexibility to respond to unexpected challenges; and eventually heightening the risk of a fiscal crisis.

CBO projects deficits will rise over the next decade as the gulf grows between spending and revenue. Spending will increase from 20.3 percent of GDP in 2015 to 22.3 percent by 2025. Meanwhile, revenue will stay largely flat at around 18 percent of GDP for the ten-year period, reaching 18.3 percent of GDP in 2025. Both of these 2025 totals, but especially spending levels, are above the 50-year historical averages of 20.1 percent and 17.4 percent of GDP for spending and revenue, respectively.

In addition to updating their budget forecast, CBO has also updated its economic projections, revising economic growth downward in 2015 and 2016. This change may be due to the fact that CBO’s estimates are based on data available in early December 2014. More recent data not captured in the report, suggest stronger-than-expected GDP growth in the second half of 2014. Therefore, a future CBO revision may amend economic projections upward. Compared to the previous August baseline, CBO predicts lower unemployment in the near term and reduced interest rates throughout the ten-year period.

CRFB will be publishing a full analysis of CBO’s report later today, but the key message is clear. The long-term debt picture remains unsustainable, and the recent trend of falling deficits will soon reverse.

Lawmakers must act to prevent the significant rise in debt that these projections show, and the sooner they begin to do so, the better. At the very least, lawmakers should not make the situation worse by abiding by pay-as-you-go rules for any new legislation they pass and responsibly addressing the six Fiscal Speed Bumps that will force lawmakers to act this year.

We'll be publishing a more complete analysis later today. Click here to read the CBO report.