CBO Releases 2018 Long-Term Outlook

The Congressional Budget Office (CBO) just released its annual Long-Term Budget Outlook, which shows the United States is on an unsustainable fiscal path.

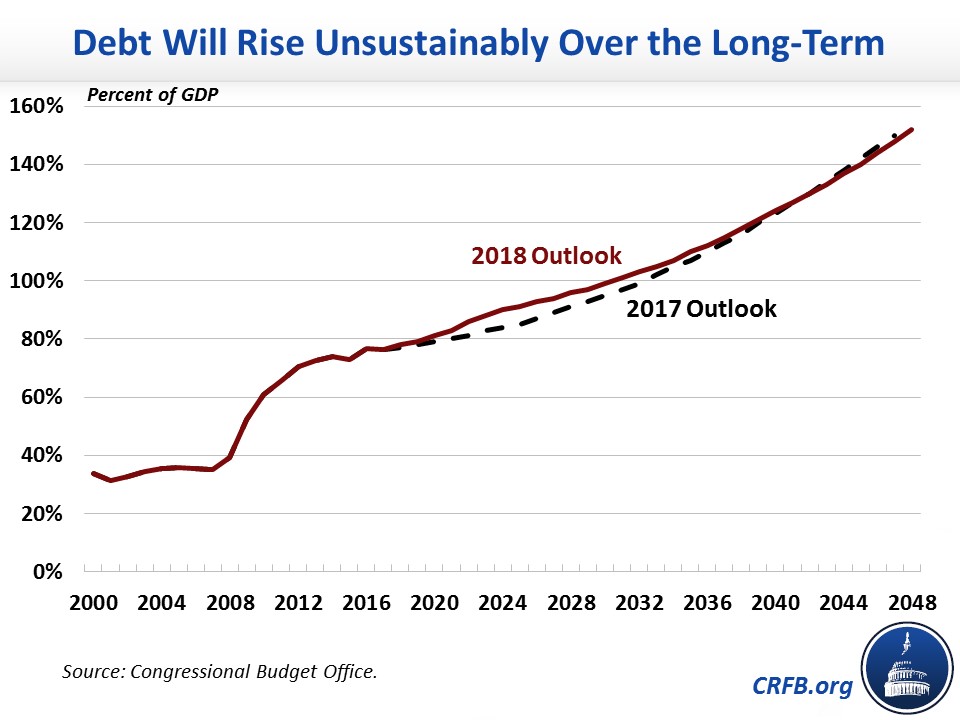

Under current law, CBO projects debt held by the public will exceed the size of the economy by 2031, set a new record of 107 percent of GDP by 2034, and reach 152 percent by 2048. In other words, debt will nearly double over the next 30 years under current law.

If various expiring tax cuts and spending increases are extended, debt will grow much higher.

CBO's current law debt projections show debt higher than last year's projections over the next two decades, but similar over the longer term – since new budget-busting tax cuts and spending increases are largely temporary. Later today, the Committee for a Responsible Federal Budget will produce rough estimates of debt levels assuming these policies are continued.

Rising debt results from widening budget deficits, which CBO projects will more than double from 3.9 percent of GDP in 2018 to 9.5 percent of GDP by 2048 under current law.

The largest contributors to this growth are the rising costs of Social Security, health care spending, and interest on the debt outpacing revenue growth. Growth in these areas will lead spending to increase from 20.6 percent of GDP today to 29.3 percent in 2048 under current law. Revenue, meanwhile, will fail to keep up – rising from 16.6 percent of GDP today to 19.8 percent by 2048 under current law.

Failing to confront this growing debt burden will lead to harmful consequences. CBO warns:

If current laws generally remained unchanged, the Congressional Budget Office projects, growing budget deficits would boost that debt sharply over the next 30 years; it would approach 100 percent of GDP by the end of the next decade and 152 percent by 2048. That amount would be the highest in the nation’s history by far. Moreover, if lawmakers changed current law to maintain certain policies now in place—preventing a significant increase in individual income taxes in 2026, for example—the result would be even larger increases in debt. The prospect of large and growing debt poses substantial risks for the nation and presents policymakers with significant challenges.

At the same time, CBO projects all major trust funds will run out of reserves in the next 14 years; the theoretically-combined Social Security trust funds will be insolvent by 2031.

To make matters worse, CBO's numbers assume the expiration of many recent tax cuts and spending increases that prevent the debt from growing more rapidly. Assuming extensions, the fiscal situation will be much more dire.

Lawmakers need to come to the table and address this situation before it gets further out of hand. That will require looking at ways to fix the tax law, set reasonable and responsible discretionary spending levels, curb the growth of health care spending, make Social Security solvent, and pursue a mix of further revenue increases and spending cuts sufficient to put the debt on a downward path relative to the economy.

As CBO shows in its report, the longer we wait to make these changes the larger and harder they will be.

Stay tuned for more analysis on the Long-Term Budget Outlook today and throughout the week.