CBO is Pretty Good at Estimating Spending

In March 2016, CBO estimated the federal government would spend $4.06 trillion for fiscal year (FY) 2017 – a number that would increase to $4.08 trillion when legislative changes are incorporated. Actual spending was $4.01 trillion – just 1.6 percent lower. In a recent report, CBO breaks down this very small forecasting error, showing that its overall projections are quite accurate and reinforcing CBO's well-deserved reputation as a sophisticated and unbiased estimator.

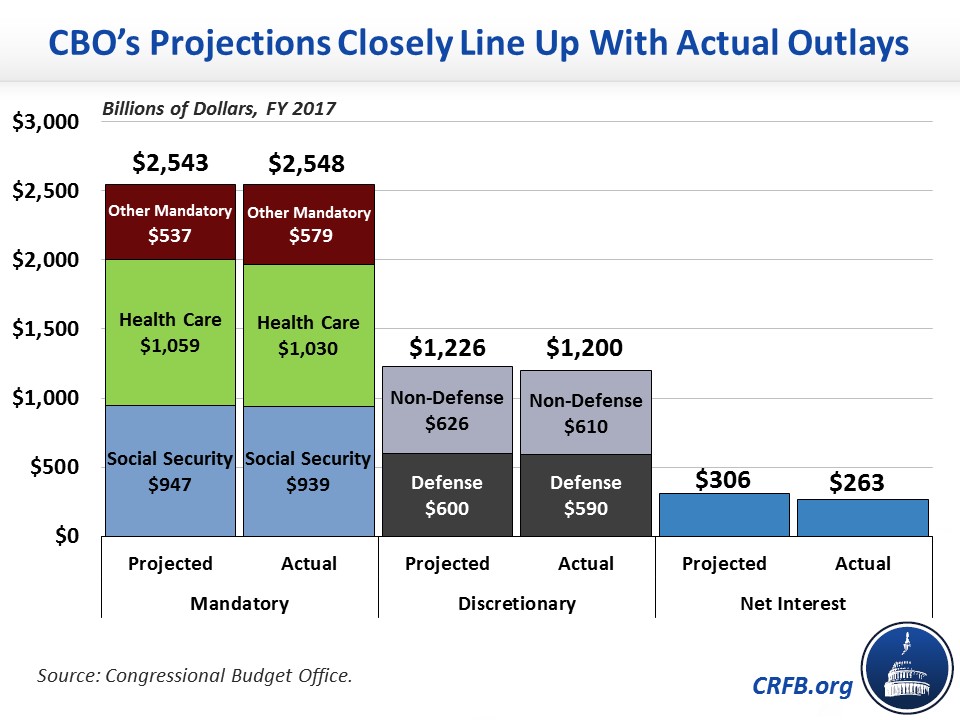

The new report shows that, on the discretionary side, actual spending was $26 billion lower than projected – $1.200 trillion as opposed to $1.226 trillion. Interest spending was $43 billion lower ($263 billion as opposed to $306 billion). On the other hand, mandatory spending was $4 billion higher – $2.548 trillion as opposed to $2.543 trillion (numbers do not add due to rounding).

The largest differences in discretionary spending were the result of defense procurement and operations happening slower than CBO had anticipated as well as larger offsetting receipts from federally-guaranteed mortgages. Interest spending differed largely because CBO projected interest rates to rise faster than they did in 2017. And on mandatory spending, CBO's errors netted out from unanticipated reestimates in the cost of credit subsidies combined with slightly overestimating Social Security and health care payments.

CBO's total error of 1.6 percent error rate was lower compared to its average net error of 2.2 percent over the past quarter century and about a third less than CBO's mean absolute error rate of 2.3 percent. As CBO has shown in other reports, errors tend to be larger – both on the revenue and spending side – looking further in the future. But absent major, unanticipated economic shifts – for example, a recession – errors have tended to be relatively modest even over a five- or ten-year period.

Still, there is room for CBO to improve. In its report, CBO identified several areas where it needed to make adjustments to improve accuracy. Among them included changing the way CBO evaluates enrollment in programs like the Children's Health Insurance Program, fine-tuning how quickly the Defense Department spends its funds, and reexamining interest rate projections. All of these adjustments will make future projections more accurate, showing how the agency continues to evolve with the data and literature available for its projections.

We hope to see more reports like this, as it shows how CBO evaluates itself and makes it more transparent as to where its errors come from. The agency's recent efforts to improve transparency have not gone unnoticed, and they will definitely help dissuade those who decry it as "always wrong." Quite the contrary, CBO's numbers – which are meant to represent a central estimate among a range of likely outcomes – are perhaps the best out there.