CBO Economic Forecast Sees Major Headwinds Facing Growth

Predicting what the economy will look like over the next 30 years is no easy task, but the assumptions in the Congressional Budget Office’s (CBO) Long-Term Budget Outlook provide a good standard for what realistic long-term growth projections should look like. CBO expects that the economy will not grow as fast over the next three decades as it has in the past, pointing to several factors likely to limit growth. CBO’s analysis also shows that while policies that boost growth can make a meaningful impact in improving the budget outlook, growth alone is not sufficient, with debt projected to rise as a share of Gross Domestic Project (GDP) even under the rosiest of economic assumptions.

How Fast Does CBO Think the Economy Will Grow?

CBO projects real potential GDP (the amount of goods and services produced when the economy is running at full capacity) will grow an average of 1.9 percent per year over the next 30 years – considerably lower than its historical average. Between 1950 and 2016, real potential GDP grew at a rate of almost 3.2 percent, with about 1.4 percent coming from labor force growth and 1.7 percent coming from the growth of potential output per worker. CBO projects that growth in potential output per worker will continue at a reduced but generally similar pace, averaging 1.5 percent annually over the next three decades. Potential labor force growth meanwhile will slow dramatically, falling to 0.4 percent per year between 2017 and 2047. This slower projected growth in the potential labor force is largely the result of the aging of the population as well as the slowdown in the growth of women’s labor force participation after decades of increases.

Fiscal policy will also limit growth. Even without changes in tax policy, average effective marginal tax rates on labor and capital income will rise due to factors like real bracket creep, reducing incentives to work and save and dampening economic activity. Meanwhile, federal support for pro-growth public investments will decline as a share of GDP. Most important in CBO's view, however, is the reduction in private investment caused by the rising federal debt, which will increase from its current level of 77 percent of GDP to 150 percent by 2047. CBO estimates that without the negative economic effects of higher debt, GDP in 2047 would be nearly 3 percent larger, and per-capita income would be about $4,000 higher.

How Does Growth Affect the Debt?

The pace of economic growth has important implications not only for future national output and standards of living, but also fiscal sustainability. Faster growth and larger incomes mean greater tax revenues, reducing the budget deficit. And the larger the economy, the more public debt it is able to bear without significantly undermining private investment.

As it did last year, CBO provided information on how changes in two key components of economic growth – labor force participation and total factor productivity – would change the long-run budget outlook (CBO also analyzed the effects of changes in interest rates and health care costs, which we will address in a later blog).

Labor Force Participation

Part of the slow growth of the labor force is due to the decline in fertility rates and slower overall population growth, but another reason is that a smaller share of the population will be in the workforce. While CBO has significantly raised its projection of the labor force participation (LFP) rate since last year, it still expects the share of people working or looking for work to decline considerably over time, dropping from 62.8 percent in 2017 to 59.3 percent in 2047 and averaging about 60.6 percent over the 30-year period. Almost all of this decline is due to the aging of the population; on an age-and-sex-adjusted basis, the overall LFP rate will stay roughly stable for the next 30 years. Other trends affecting LFP are expected to roughly offset one another. For example, CBO expects the LFP of prime-working-age men will continue to decline, but rising longevity will lead people to work longer.

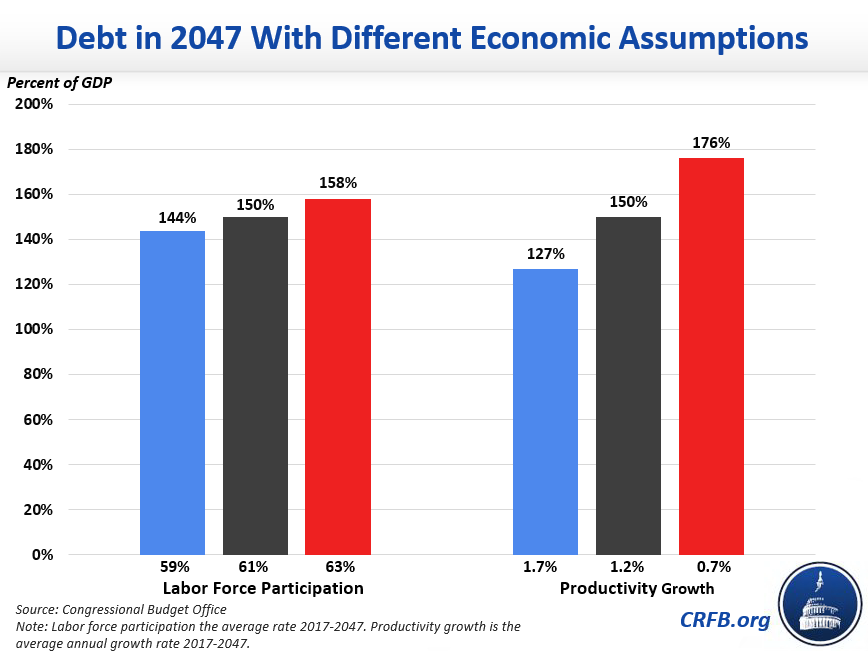

Different LFP rates have a modest but noticeable impact on CBO’s debt projections: debt would be 158 percent of GDP in 2047 if the LFP rate averaged about 2 percentage points lower over the next 30 years or 144 percent if the average rate were about 2 points higher, compared to the agency's baseline estimate of 150 percent.

Productivity

CBO expects that total factor productivity (the share of economic growth not explained by additional labor or capital) will grow more slowly than its historical average, increasing by 1.2 percent per year through 2047 compared to nearly 1.5 percent since 1950. The cause of the recent productivity slowdown is hotly debated, but CBO points to two persistent trends likely to push growth downward in the decades ahead. As noted above, CBO expects non-defense discretionary spending – the portion of the budget that includes productivity-boosting federal investments in infrastructure, education, and research – will shrink to a much smaller percentage of GDP than it has averaged in the past, causing productivity to grow more slowly. In addition, growth in labor quality is expected to slow as average educational attainment levels stay flat and well-educated baby boomers start to retire.

Higher productivity growth would tend to raise interest rates, but on net would significantly improve our fiscal situation by increasing tax revenues and the size of the economy. CBO estimates debt in 2047 would be 127 percent of GDP if total factor productivity grew 0.5 percentage points faster or 176 percent if growth was 0.5 points lower.

Even if LFP and total factor productivity growth were both higher over the next 30 years, debt would still rise as a share of GDP from its current levels. That does not mean higher LFP or productivity wouldn't improve the budget outlook, or that policies that raise them are not worth pursuing. As our co-chairs encouraged in their memo to the new Administration, policymakers should pursue a host of structural reforms to maximize long-run growth, but they should not depend on growth as the sole solution to our fiscal troubles.

***

CBO's analysis highlights a number of reasons to expect the economy will not grow as quickly as it has in the past. It also shows that policies capable of boosting labor force participation and productivity can make a meaningful difference in slowing the growth of debt over time. But even in the best-case economic scenario, debt is not something we can just grow our way out of. That's why the best way for policymakers to improve long-run growth would be to enact fiscally responsible policies – such as making trust fund programs solvent or tax reform that is paid for – rather than fiscally irresponsible ones.