CBO on the Caps

The caps on discretionary spending were, of course, the concrete centerpiece of last week's budget deal. Considering the importance of the caps, CBO published a blog explaining how they work and what would happen to discretionary spending over the ten-year window.

First, they go into some background on the caps:

Because the Congress sets funding for discretionary programs each year, cutting spending through the regular appropriation process can ensure only short-term savings. An approach to try to ensure longer-term savings that has been used in the past and that is used again in the Budget Control Act of 2011 is to set overall limits on discretionary spending for future years.

Statutory caps on discretionary spending were imposed in 1990, and extended in 1993 and 1997, before expiring in 2002. Many observers agree that as long as a consensus remained to rein in budget deficits, the spending caps helped curb the growth of discretionary spending. Such spending increased at an average rate of only 1.6 percent a year during the 1990s. When budget deficits gave way to surpluses late in the decade, however, the caps were overridden in the appropriation process and later allowed to expire. Since 2001, discretionary spending has increased at an average annual rate of 8.2 percent.

Then, they detail specific information about how these caps would work:

The Budget Control Act of 2011 sets caps on appropriations of new discretionary budget authority that start at $1,043 billion in 2012 and $1,047 billion in 2013, and then grow by about 2 percent per year thereafter, reaching $1,234 billion in 2021. (Discretionary appropriations for 2011 totaled $1,067 billion; some provisions in the 2011 appropriation act affected mandatory spending, and the legislation was credited with $17 billion in reductions of budget authority for mandatory spending.) By 2021, under these caps, discretionary appropriations will be about 9 percent less than CBO’s baseline projections, which reflect an assumption that future appropriations will be the same as those provided for 2011 plus adjustments for inflation.

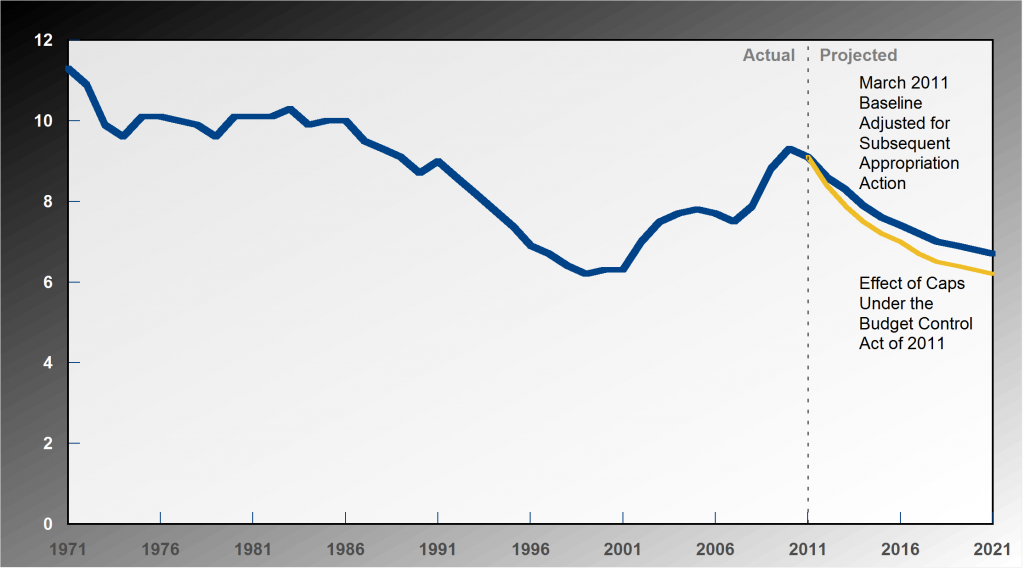

In addition, they show the discretionary spending path as a percentage of GDP compared to their March baseline. Discretionary spending would decline as a percentage of GDP under any CBO baseline, because it is assumed to grow with inflation which grows more slowly than GDP. However, under the new path, discretionary spending declines more quickly and more sharply, reaching levels comparable to the late 1990's.

Discretionary Spending (Percentage of GDP)

The discretionary caps are a good first step to reining in our budget deficits, but we need to do more on all aspects of the federal budget. Lawmakers need to continue the momentum that has been building for a comprehensive debt-reduction plan and must expand the goal of the special Joint Committee of twelve lawmakers to find more than $1.5 trillion in additional savings. We will need it if we are to succeed at reducing the debt as a share of the economy.

For more information about the discretionary spending caps in the Budget Control Act, check out CBO's full blog post here.