Canceling Student Loan Debt Is Poor Economic Stimulus

Note: We published a follow-up piece on June 3, 2021 estimating the fiscal multipliers for cancelling $10,000 and $50,000 in federal student loan debt, which can be found here. We estimate a multiplier of .02x to .27x with a central estimate of .13x for cancelling $10,000 of debt and .10x for cancelling $50,000.

Facing a weak economy still suffering from the effects of the COVID-19 pandemic, there have been a number of calls for President-elect Joe Biden to support the economic recovery by cancelling some or all student loan debt.

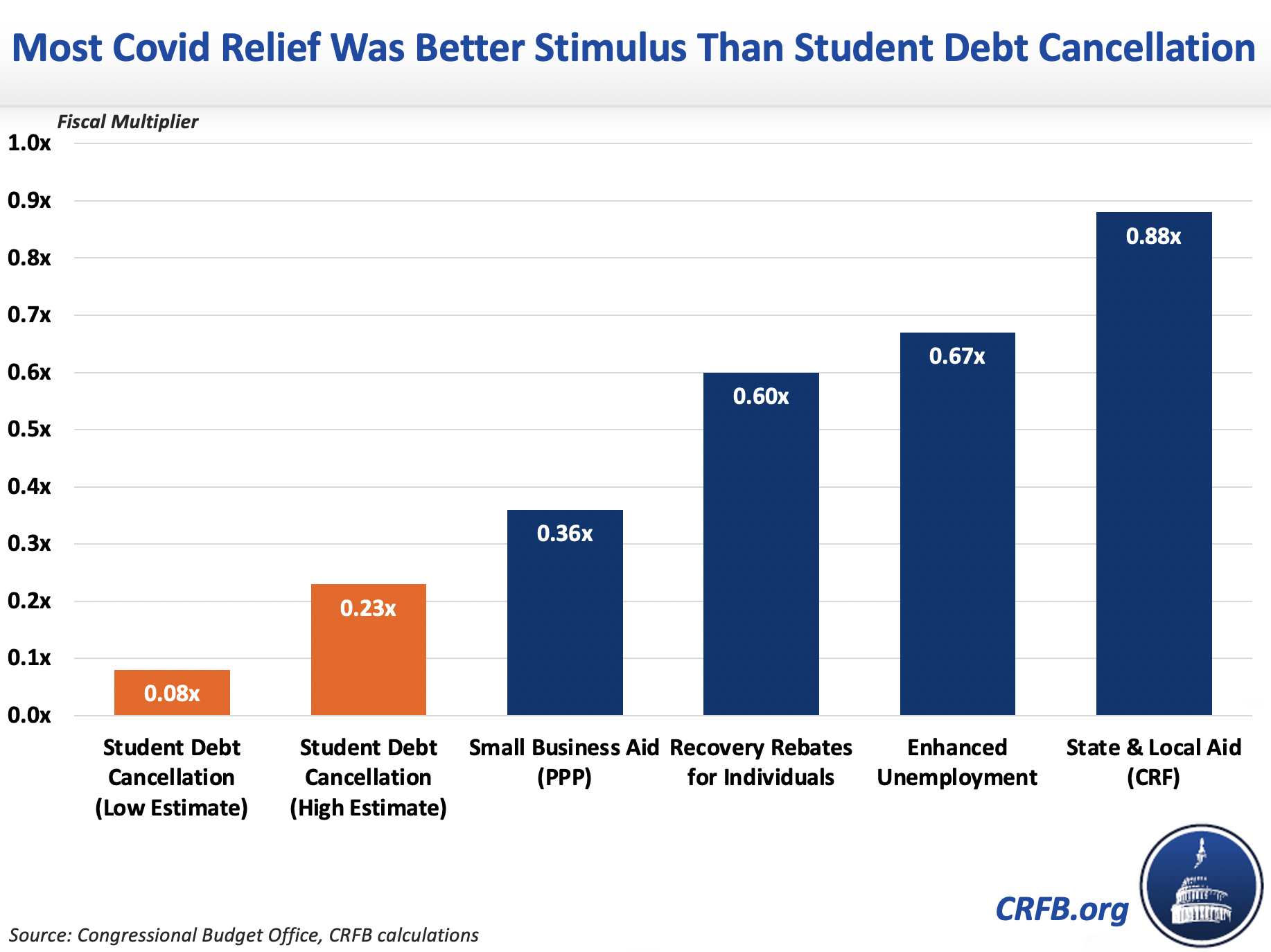

There is a debate over whether the President has the legal authority to cancel debt by executive order and whether or not it would be good policy overall. However, one thing is clear: student debt cancellation would be an ineffective form of stimulus, providing a small boost to the near-term economy relative to the cost. Assuming the loans would be forgiven tax-free, we estimate an economic multiplier of 0.08x to 0.23x.

In this analysis, we show:

- Student debt cancellation will increase cash flow by only $90 billion per year, at a cost of $1.5 trillion.

- Student debt cancellation is poorly targeted to those most likely to spend, given that nearly three-quarters of repayments would come from the top 40 percent of earners.

- Forgiving the full $1.5 trillion in loans will likely boost economic output during the current downturn by between $115 and $360 billion, a multiplier of 0.08x to 0.23x.

- Partial loan forgiveness would cost less than total but also offer a smaller economic boost. We don’t expect a significant improvement in the multiplier.

- Simply extending the current executive action to defer loan repayments and cancel interest would achieve much of the economic benefit of loan cancellation at only a very small fraction of the cost.

There are a number of benefits and costs associated with cancelling student debt. But as a stimulus measure, its "bang for buck" is far lower than many alternatives under consideration or the COVID relief already enacted.

Loan Forgiveness Offers Little Spendable Cash

Economic stimulus works by increasing total spending when the economy is in a period of weakness. Yet forgiving student loan debt will have a relatively small effect on what is available to be spent.

Total loan forgiveness would increase household wealth by about $1.5 trillion (costing the government the same), but that is the not the equivalent of sending $1.5 trillion of cash to households. Instead of giving the average household $15,000 or $20,000 more to spend, it would relieve them of their monthly interest and principal payments, which normally total $200 to $300 per month for the typical borrower in repayment.

In other words, because borrowers often pay back their loans over 10, 15, or even 30 years, debt cancellation will increase their available cash by only a fraction of the total loan forgiveness.

Our analysis of the student aid portfolio suggests that eliminating $1.5 trillion in loans would translate to $90 billion or less of cash available to spend in 2021 and $450 billion or less over 5 years.1 Cancelling only some debt – for example by imposing a $10,000 or $50,000 cap – would reduce costs and cash flow effects roughly proportionally.2

Those figures might overestimate the new cash flow given current tax law. Generally, the amount of loan forgiveness is treated as income and subject to tax. As Jason Furman, former Chair of President Obama’s Council of Economic Advisers, has pointed out, the immediate taxes owed on that forgiveness could be larger than the near-term loan payment savings. Under this tax treatment (which some have argued could be changed or is a misunderstanding of current law), loan forgiveness might have no stimulative effect in the near-term.

On the other hand, the absence of future debt may lead some individuals and households to spend more by withdrawing from their savings or taking out alternative loans, a phenomenon known as the wealth effect. Empirical evidence suggests that increases in the value of one’s house or stock portfolio increase spending by 3 to 6 cents for every dollar increase in wealth. This would translate to roughly $50 to $100 billion of additional spending. That’s a small economic impact relative to the $1.5 trillion cost.

Loan Forgiveness is Poorly Targeted to Those Who Will Spend

Not only would loan cancellation provide relatively little spendable cash to households, but the cash it does offer would be poorly targeted from a stimulus perspective.

Stimulus dollars that are spent rather than saved provide a stronger boost to near-term economic output. In general, those with low incomes or who have experienced recent negative income shocks are most likely to spend additional resources. Yet a large share of debt cancellation would go to those with higher incomes and those who have maintained their income during the current crisis.

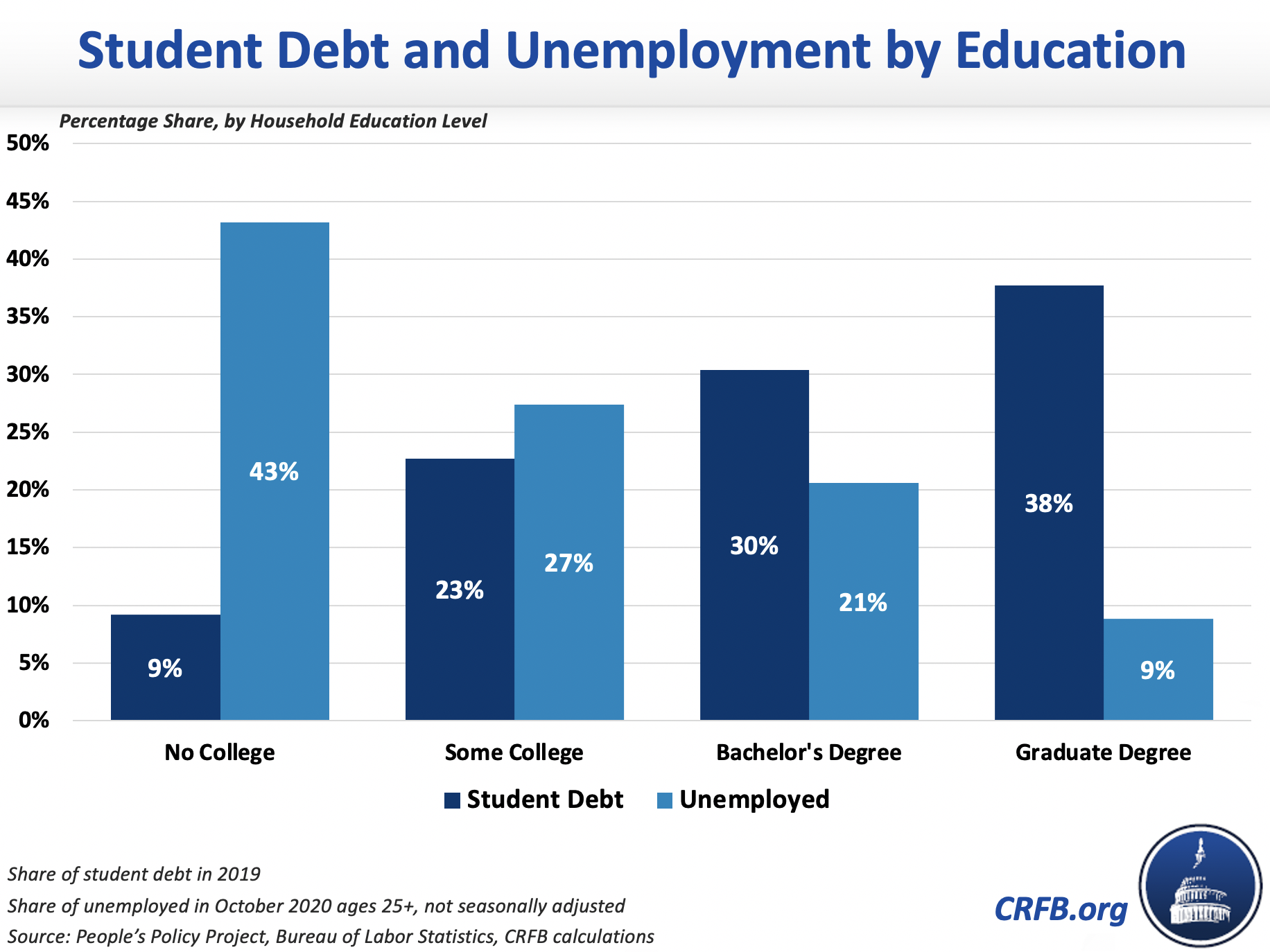

The majority of those most affected by the current economic crisis likely have little or no student debt. Over 70 percent of current unemployed workers do not have a bachelor’s degree, including 43 percent who did not attend college at all. Meanwhile, less than one-third of all student debt is held by households without a bachelor’s degree and less than a tenth is held by those with no college education. Indeed, about two-fifths of all student debt is held by households with graduate degrees. That group makes up less than a tenth of the total unemployed.

A recent Pew survey similarly shows that most economic suffering from the pandemic is concentrated among those with less education and thus less (or no) student debt.

Based on this data, it is unlikely that broad student debt cancellation would be well-targeted toward those experiencing income loss. Nor is it well targeted toward those with low incomes. The Brookings Institution recently estimated that nearly three-quarters of student loan payments in a given (pre-pandemic) month are made by those in the top two quintiles. Only a tenth of loan payments come from the bottom two quintiles, which are the groups most likely to spend.

The small amount of payments by low-income borrowers is mostly due to the distribution of loans themselves. But it’s also because those struggling with student debt can already benefit from lower repayments under income-based repayment programs or, for short-term income shocks, pre-pandemic forbearance and deferment options.

With forgiveness dollars poorly targeted to those likely to spend – either based on income or income loss – the cash flow savings to borrowers are unlikely to have a high multiplier. CBO recently estimated that the CARES Act recovery rebates – which gave $1,200 per adult and $500 per child to nearly all families making less than $150,000 per year – had a multiplier of 0.6x. Loan cancellation is substantially less targeted than these rebates – which are already relatively untargeted – and thus is likely to have a much lower multiplier.

Targeting would be somewhat improved by capping the amount of loan forgiveness at, say, $50,000 or $10,000 (as in President-elect Biden’s campaign plan); or by targeting by income, but any form of loan cancellation goes only to those with some amount of college education who borrowed for school. Therefore, even a better targeted version is likely to be less stimulative than universal checks and far less stimulative than more targeted interventions such as expanded unemployment benefits.

Loan Forgiveness Has a Very Small Multiplier, and Similar Stimulus Could be Provided at a Fraction of the Cost

Assuming a 0.4x to 0.6x multiplier from additional cash flow from loan forgiveness, in combination with a 3 to 6 percent wealth effect, $1.5 trillion of debt relief might produce between $115 and $360 billion of economic output during the current downturn.3 That suggests a multiplier of 0.08x to 0.23x.

These multipliers are far lower than almost any other policy currently under consideration or enacted in recent COVID relief. For example, CBO estimated that recent unemployment benefit expansions had a multiplier of 0.67x and broad recovery rebates had a multiplier of 0.60x – both of which would be higher in future legislation due to less social distancing.

Debt cancellation is especially poor stimulus when compared to the alternative of continuing the student debt relief policy currently in place. Since March 13, a combination of legislative and executive actions have deferred nearly all student loan payments and forgiven interest accrued during that time. As a result, only 7 percent of student loan dollars are currently in repayment – leaving most households with additional cash to spend.

This deferral is scheduled to end on December 31 but can be continued through the remainder of the pandemic through executive action. Extending this policy would generate most of the economic boost that would come from debt cancellation, but at only a small fraction of the cost.

1 This assumes that all outstanding federal student loans would be cancelled, including those in the Federal Family Education Loan (FFEL) program. However, the portion of these loans held by private lenders may not be eligible for cancellation and thus some or all may ultimately not be cancelled.

2 The flexibility afforded in repaying federal student loans through income-based repayment options means that cancelling $10,000 would not lead to a proportionate increase in cash flows. Right now, anyone with a student loan can enroll in a repayment plan that ties their monthly payment to their income. CBO estimated in February that nearly half of dollars in being repaid in the main “Direct Loan” program were through income-based plans. So even without the current interest forgiveness and automatic forbearance, many people enrolled in Income-Driven Repayment plans would not see any change to their monthly payments. It would, of course, completely eliminate payments for those who had less than $10,000 in debt, but for those with more, it will merely shorten their time to paying off the loan, not decrease the amount. That will not stimulate the economy in the short term. Indeed, of all types of credit programs to offer relief on, the student loan program is the least stimulative since repayment is the most flexible.

3 Evaluation of stimulus should focus on the effect it might have in lifting a weak economy toward full employment. Under most macroeconomic models, stimulative effects disappear or differ substantially (possibly in direction) when the economy is at or near its potential. Our low-end estimate assumes the pandemic to have ended and the economy to have largely normalized after two years. Our high-end estimate assumes the economy remains in a weakened state over five years.