Are Bond Markets Signaling the "Announcement Effect"?

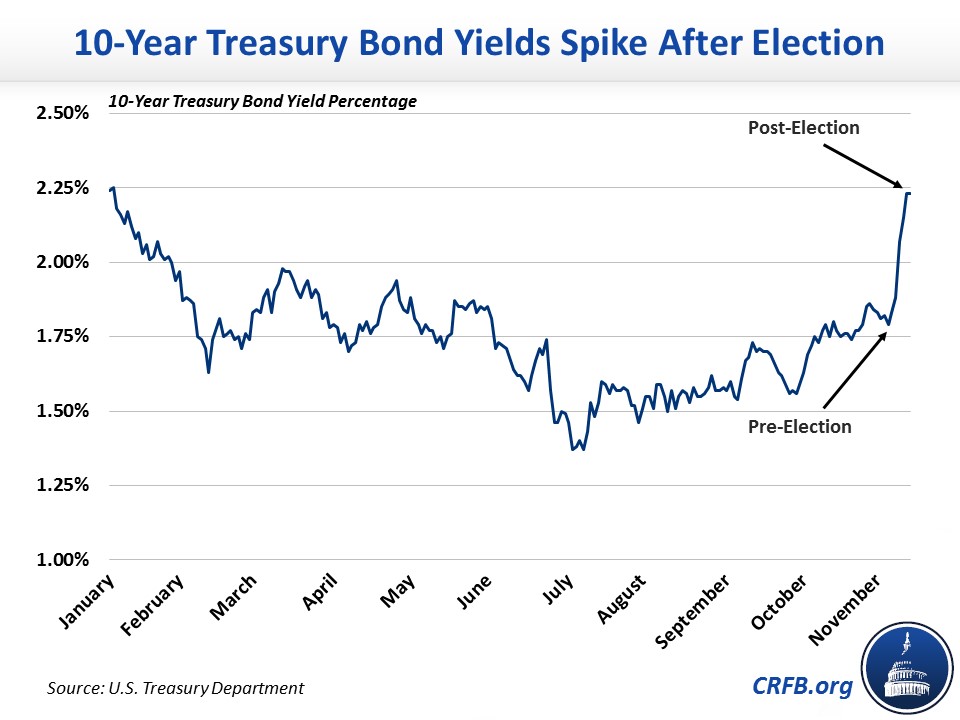

Since last week's election results, markets have reacted by pushing the yield for ten-year Treasury bonds up more than 0.3 percentage points to 2.2 percent – their highest point since January. One of the causes in this spike is believed to be from anticipating the enactment of President-elect Donald Trump's proposals, which we estimated would add over $5 trillion to the debt on top of our current debt trajectory.

One explanation for this interest rate spike could be related to what we have previously called the "Announcement Effect Club" – the idea that announcing a plan to reduce the long-term fiscal gap would result in positive economic effects. In this case, a plan to increase the debt might have created negative effects before such a plan is even enacted; the combination of Trump's current proposals for tax cuts and infrastructure would expand deficits and, without a plan to control them, increase the likelihood that the fiscal situation deteriorates even quicker than currently projected.

As we’ve explained before, higher interest rates resulting from high levels of debt can flow through the entire economy, raising interest rates on mortgages, credit cards, and business loans while crowding out productive investment and therefore slowing economic growth.

Higher interest rates also impact government spending and debt directly. Over the next decade, government interest payments are projected to be the fastest growing part of the budget and are on course to nearly triple, from $248 billion (1.4 percent of Gross Domestic Product) in 2016 to $712 billion (2.6 percent of GDP) by 2026, largely a result of a projected rise in interest rates and the growing debt burden. The more the federal government spends to service its debt, the less available for other important priorities and the more it will likely have to borrow overall.

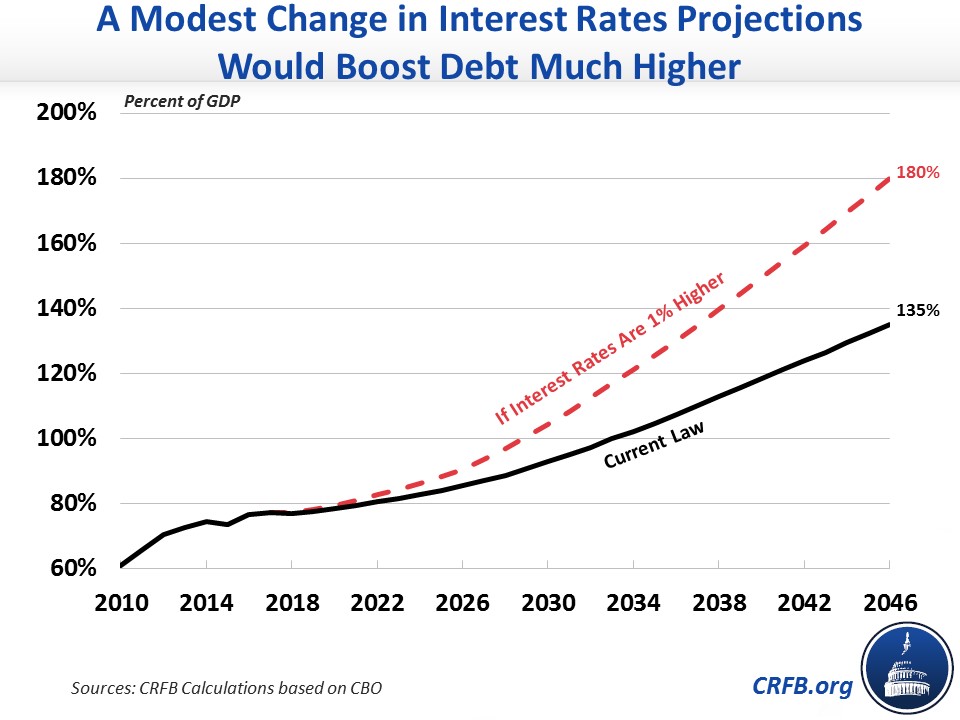

Indeed, if interest rates rise faster than projected, as recent trends suggest they might, the situation would be even worse. Under current law, we project debt to grow to around 135 percent of GDP by 2046. If interest rates rose just 1 percentage point higher – still staying below their historical average – debt would instead reach 180 percent of GDP.

While some have argued that we shouldn't worry about our growing debt burden because interest spending as a percentage of GDP, that argument ignores how modestly higher interest rates could worsen debt even quicker than currently projected.

To counteract this effect, policymakers should put forth plans that would enact entitlement reforms, revenue-raising tax reform, and spending restraint to improve our fiscal health and initiate the Announcement Effect that will strengthen the economy.