Administration Takes Up Transit Spending with the GROW AMERICA Act

The Administration recently submitted a $302 billion, four-year transit proposal to Congress to address the chronic challenges facing surface transportation spending. The GROW AMERICA Act would restructure the Highway Trust Fund (HTF), dedicate new revenue to the trust fund from corporate tax reform, and suggests new budgetary treatment for transit funding.

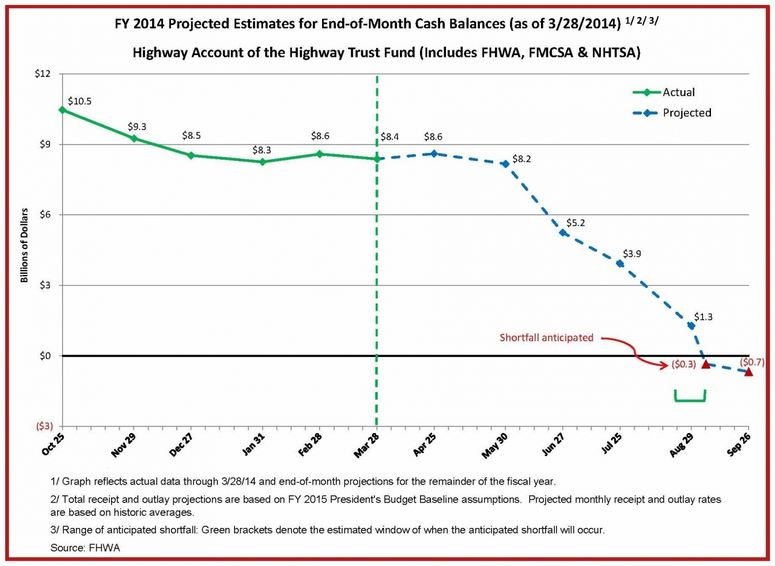

While the current authorization for transportation spending expires at the end of September, the Department of Transportation estimates that the Highway Account of the HTF will face a shortfall before then, possibly by late August or early September. The Congressional Budget Office projects that the HTF will be depleted sometime in FY 2015.

Source: Department of Transportation

Because the trust fund’s outlays have tended to outpace its receipts since 2000, lawmakers have repeatedly transferred money from the general fund to the trust fund. Since 2008, Congress has transferred roughly $53 billion in general revenues to the HTF, with only the latest transfer of $18.8 billion being partially offset with savings elsewhere in the budget (including the pension smoothing gimmick). House Speaker John Boehner has publicly rejected another bailout of the trust fund, which suggests that he would oppose another general revenue transfer. The Mass Transit Account is slightly more solvent with a projected balance of $1 billion at the end of FY 2014.

The Administration's proposal would establish a Transportation Trust Fund (TTF) to replace the HTF. This new TTF would include Highway and Mass Transit Accounts as the HTF currently does, but it would also create Rail and Multimodal (to coordinate across different means of transportation) accounts. These new accounts would receive General Fund transfers and new revenue from business tax reform but would not receive a portion of the taxes on motor fuels that finance the two existing HTF accounts.

The Administration proposal would change the budgetary treatment of spending from the HTF to classify both highway contract authority and outlays spending as mandatory spending, adopting a recommendation of the National Commission on Fiscal Responsibility and Reform (Simpson-Bowles). Under current law, contract authority for the Highway Trust Fund was treated as mandatory but outlays from that trust fund were treated as discretionary. This split budgetary treatment effectively exempts highway spending from statutory budgetary controls because discretionary spending limits apply to budget authority and pay-as-you-go rules apply to mandatory outlays; by contrast, a general revenue transfer would only increase mandatory contract authority (not subject to discretionary caps) and discretionary outlays (not subject to PAYGO). The legislation provides that any increases in transportation contract authority above the current law baseline would be subject to PAYGO. It also provides that increases in dedicated revenues (such as an increase in the gas tax) to fund current spending levels would not count as an offset for purposes of PAYGO, ensuring that increased revenues would go to trust fund solvency and not offsetting other spending or tax cuts. The legislation also shifts some programs that are currently classified as completely discretionary, but it does not include a reduction in discretionary spending limits to reflect this change in classification as the President's budget did.

The legislation includes a placeholder for reforms of budgetary treatment of general revenue transfers to the HTF with language indicating the Administration will work with Congress to determine the appropriate scoring rules for general revenue transfers consistent with the other changes being recommended. This placeholder suggests that the Administration is at least open to codifying the budget scoring rule included in the House-passed budget resolution, which would score general revenue transfers to the highway trust fund as a cost that must be offset.

In keeping with the legislation's policy of subjecting transportation spending to PAYGO, the administration proposes to cover the existing funding shortfall and fund the spending levels proposed in the bill by supplementing current dedicated revenues to the new TTF with additional revenues from corporate tax reform. Specifically, the Administration identifies the temporary increase in revenues that would be generated by repatriation of untaxed foreign earnings that U.S. companies have accumulated overseas, repealing the LIFO accounting method, and reforming accelerated depreciation as potential sources. In contrast to the proposal put forward by Ways and Means Committee Chairman Dave Camp, the revenues dedicated to the trust fund would come from a net increase in revenues from tax reform and would not be used to offset other costs within the tax reform. However, relying on revenues from corporate tax reform may be optimistic, as corporate tax reform is unlikely to be taken up before the HTF is exhausted. Additionally, since the increased revenues from corporate tax reform are likely to be temporary, they would not provide a long-term solution to the funding problems facing the trust fund. Nonetheless, the Administration deserves credit for proposing a revenue source to close the shortfall and fund proposed spending levels.

The administration submitted the legislation to advance the discussions in Congress on both the near term funding shortfalls facing the HTF and reauthorization of highway programs. We hope this will lead to further discussions on a responsible solution to the highway trust fund shortfall and greater transparency and accountability in transportation funding.